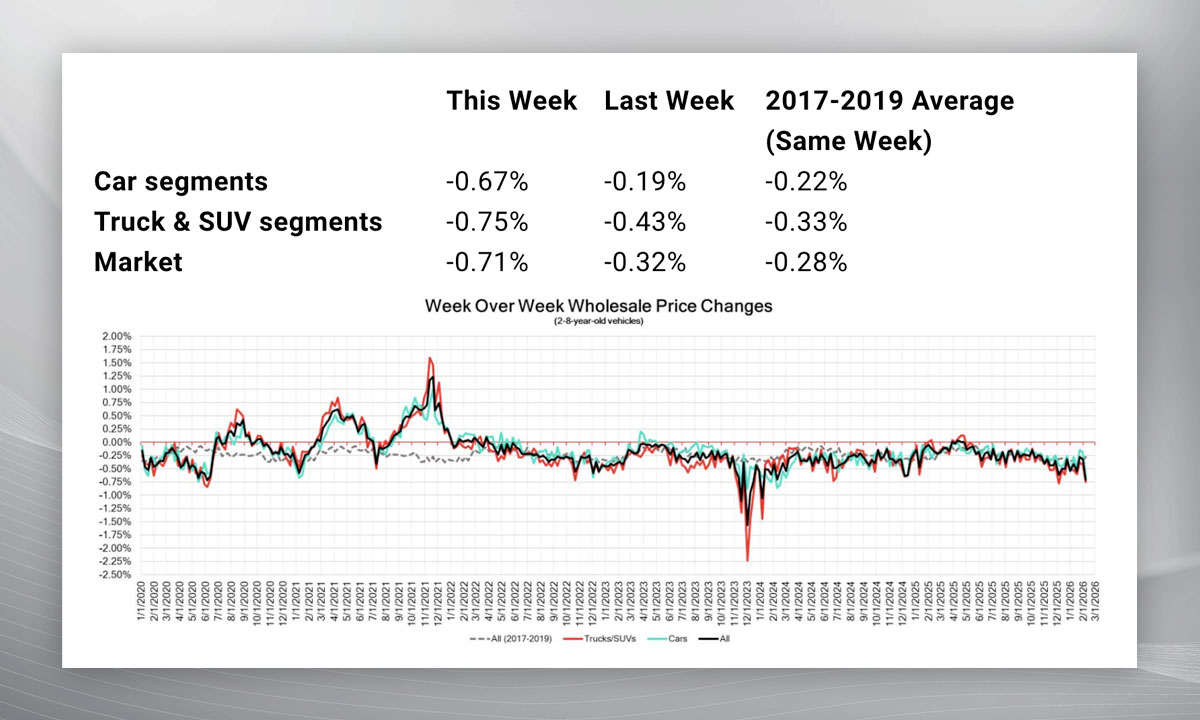

Canada’s used wholesale market weakened in the week ending Feb. 7, according to the latest Market Insights report just released this week, according to Canadian Black Book.

Overall wholesale prices fell 0.71 per cent, steeper than the 0.32 per cent decline the previous week and below the 2017-2019 same-week average of 0.28 per cent. Car segments dropped 0.67 per cent, while truck and SUV segments declined 0.75 per cent.

Among cars, sports car category values led losses at 1.41 per cent, followed by near luxury cars (1.27 per cent) and sub-compact cars (1.22 per cent). Compact car prices were down 1.05 per cent. Premium sports cars was the only segment to post a gain, up 0.32 per cent.

Truck and SUV segments also softened. Compact van values fell 1.90 per cent, compact crossovers/SUVs declined 1.51 per cent and mid-size luxury crossovers/SUVs slipped 0.99 per cent. Full-size crossovers/SUVs posted one of the smallest declines at 0.25 per cent, alongside full-size luxury crossovers/SUVs (0.30 per cent) and full-size pickup (0.46 per cent).

Auction sale rates ranged from 17.6 per cent to 88.1 per cent, averaging 44.4 per cent. Just under 91 per cent of segments recorded value movements greater than ±$100. The 14-day moving average listing price for used vehicles edged down to $36,850, based on roughly 199,000 units on dealer lots.

On the policy front, Ottawa unveiled a new Automotive Strategy that replaces the federal EV sales mandate with tailpipe emissions standards and introduces the Electric Vehicle Affordability Program, offering rebates of up to $5,000 for fully electric vehicles and $2,500 for plug-in hybrids. The plan also includes a $1.5-billion charging network investment.

January new-vehicle sales were estimated at 114,000 units, down 2.9 per cent year over year, according to DesRosiers.