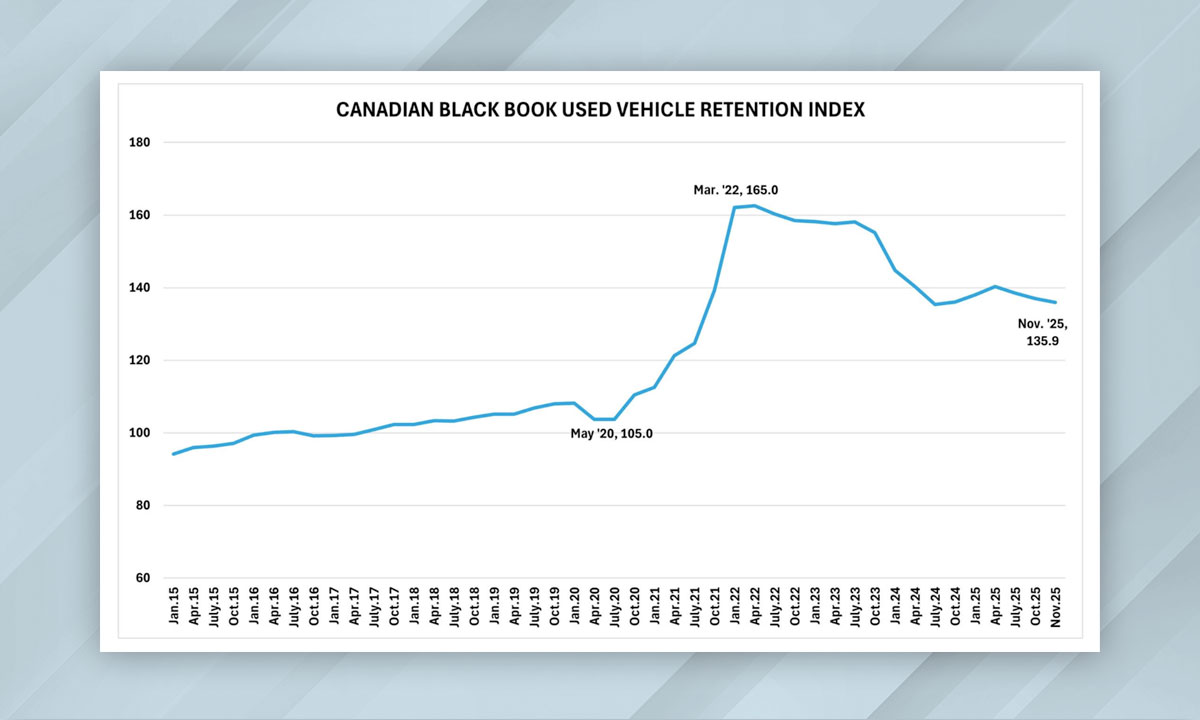

Canadian used-vehicle values slipped again in November, marking the sixth consecutive monthly decrease in the Canadian Black Book (CBB) Used Vehicle Retention Index and reinforcing signs of a broader market correction.

The index fell to 135.9 points, down from 137.0 in October and 0.2 per cent lower than a year earlier. The CBB index measures retained wholesale value for two- to six-year-old vehicles as a percentage of their original typically equipped MSRP.

“With the sixth consecutive monthly decrease — and the second largest this year — November highlights a deeper trend of market value correction as sales demand continues to slow,” said Daniel Ross, senior manager of industry insights and residual value strategy at Canadian Black Book, in a statement.

“Now, with interest rates on pause as consumers digest the current economic landscape, we expect another decline in December and a much weaker marketplace heading into 2026,” he added.

The index remains well below its pandemic-era high. In March 2022, used-vehicle values hit their highest level at 165 points after an unprecedented run that began in late summer 2020, when the market was much lower — at 100.5 points. Supply shortages, strong consumer demand and inflationary pressures contributed to that surge, but the gradual return of inventory and softer retail conditions have shifted the trend downward through 2025.

A cooling used-vehicle market may reshape pricing strategies heading into 2026. Dealers watching for shifts in consumer demand, trade-in equity and wholesale conditions may find margins tightening as values normalize from historic highs.