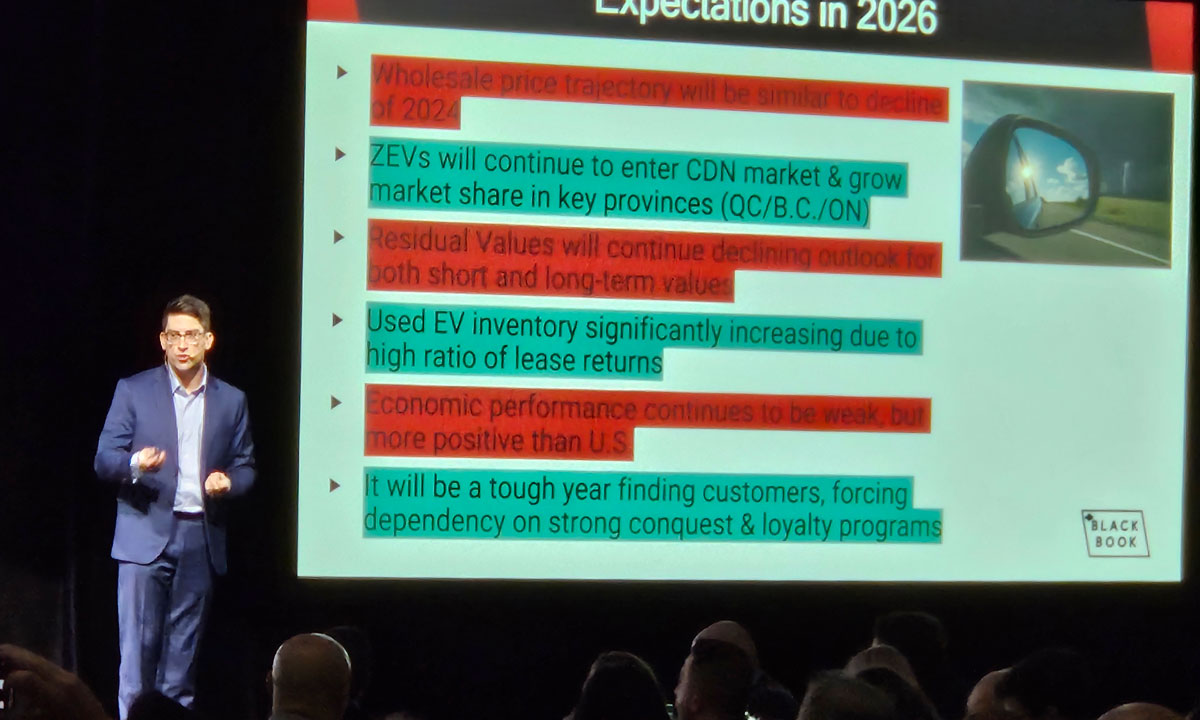

The Canadian automotive marketplace is headed for tough times in 2026 because of economic and geopolitical inconsistencies, combined with lingering effects from COVID that are wreaking havoc and creating volatility in terms of selling cars to consumers, an industry analyst forecasted.

Daniel Ross, Canadian Black Book Senior Manager of Industry Insights, projected a somewhat bleak forecast in a presentation during the 2025 Talk Auto event at the Universal Event Space in Vaughan.

“We’ve had some clear skies, some sunny weather and what we see for the remainder of 2025 and 2026 is that it’s probably going to be a little bit stormy,” said Ross. “We’re getting into some tougher times for our marketplace. There’s a lot of information and chains of events, policies and we’ve had to (adapt) to an environment where we need to strategize and bring different scenarios to see what’s going to come down the pipeline next.”

But Ross also told the audience there is a way to deal with all of the issues.

“You need to focus on what strategies and what programs we’re enforcing to bring that customer back and sell them something,” said Ross. “Bring them back early, bring them back often and try to fit them into something that really they’re more supported by. Whether it’s an electrified vehicle that’s developing in your market, in your lineup, it’s going to be tough either way. Strategize early on and get things moving in the right direction.”

Talking about the forecast for new car sales, Ross said there’s been some “induced constraints” in the marketplace time and time again. While focusing primarily on tariffs for the coming years, he said what can’t be ignored is the repercussion of the pandemic. He said that’s impacted a lot of what we’re seeing today in the used car market.

“We can see it’s about a four percent representation of downgraded volume for the next couple of years that we’re forecasting as we dived into a lot of what was coming down the pipeline in our market today,” said Ross.

He said this year will be a “weaker point” for ZEV market share. But he said that could change moving forward as things progress from this tariff-induced environment and bring to life some of the aspects of the market that are still developing. He said model availability, pricing and other obstacles are keeping consumers out of the market as we progress to the federal government’s target of 20 per cent ZEV sales by 2026, though there’s a 60-day review of that standard.

“Is there a better environment for that with no significant push immediately now as we have our zero emission mandate under review for the first target?” said Ross. “We will see how that fares as we get more information about that.”

He said insofar as the new sales environment, reduced supply needs to be taken into consideration. “We’ve spoken many times over the course of the last few years about new supply diminishing and we’re still not through everything unfortunately,” said Ross.

“We’re moving through a market that’s going to have artificially-heightened retention levels for value on most average vehicles and we’re going to get to an area where transitioning that inventory out from predominant gas vehicles to make it a larger format of plug-ins, hybrids and specifically how the EV market is developing.”

He said there will likely be just under 35,000 new EV sales this year, but added that will be developed fairly quickly because many manufacturers are developing plans and processes to bring to market a much larger capacity in the next few years. He said in the retail used pricing environment, the threat or impact of imposing tariffs moved up the price 12.5 per cent or $4,300 per vehicle on average. He said the pre-tariff new car supply is diminishing.

“We’re getting now into more post-tariff supply, where the new car price impacts are more widely spread but won’t be as widely spread as they are in the United States — fortunately for Canada as we have other avenues to mitigate that,” said Ross. “But ultimately we’re dealing with some significant demand for the new car market because of those taxes, because of the diminishing used supply, and because of the demand from the U.S. auction buyers.”

“We’re getting back to a little bit of a clawback of that retail price, about 3 per cent which is insignificant in comparison, but there’s still a ways to go.”

He said the retail market volatility on new cars has been reflected in a bunch of consumer costs that have been added through the OEMs, but the amount of increase hasn’t typically added any value.

“That’s got to be erased at some point in time, because the market isn’t inelastic to that,” said Ross.