Brand loyalty is eroding across global auto markets as consumers grow more open to electric vehicles, online purchasing, and new entrants from China, according to a new report from Boston Consulting Group (BCG).

The study, based on a survey of more than 9,000 consumers across 10 countries, points to a reshaped automotive landscape where innovation, digital convenience, and value increasingly outweigh legacy brands.

Nearly two-thirds of European consumers say they’re willing to switch automakers, a sharp departure from the traditional loyalty that long defined markets like Germany and France. At the same time, 71 per cent of current EV owners plan to stick with electric for their next purchase, suggesting growing confidence in the technology despite persistent charging concerns.

“Automakers can’t just follow the market — they need to shape it,” said Albert Waas, leader of BCG’s Automotive and Mobility practice in Europe, the Middle East, South America, and Africa and a coauthor of the report. “Listening to consumers, localizing products, and leading in software and technology will define the winners of the next decade.”

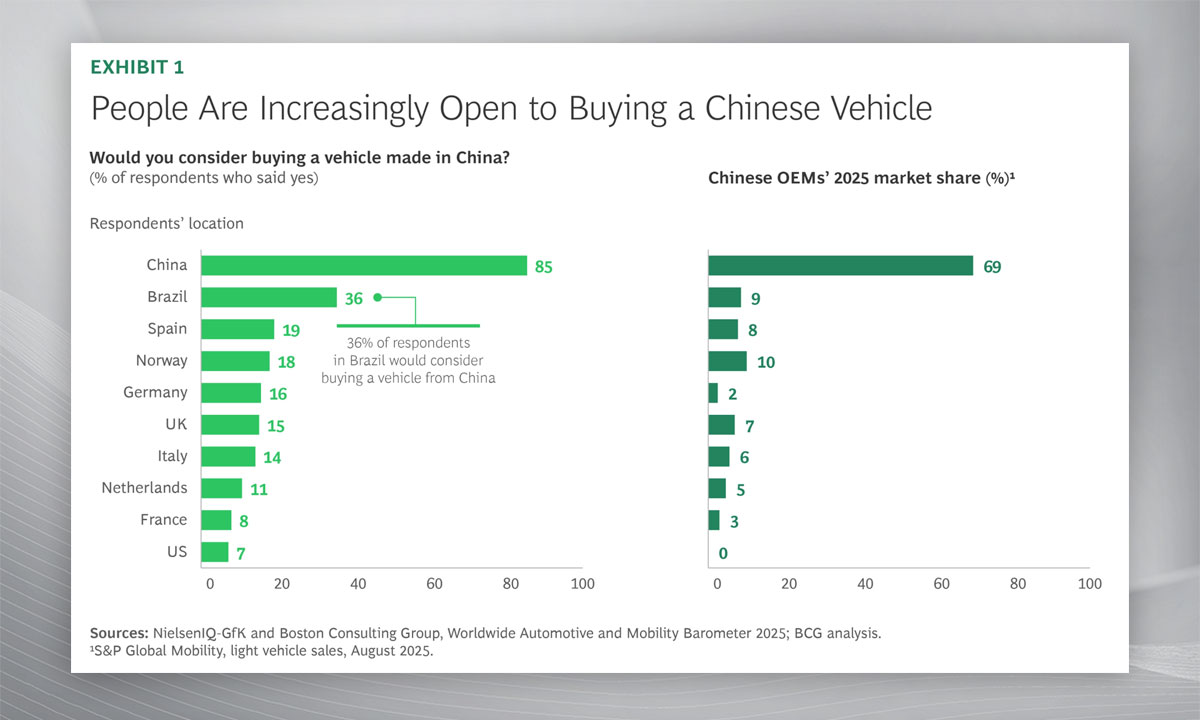

Chinese OEMs are gaining attention well beyond their borders. BCG reports that 36 per cent of Brazilian consumers and between 10-20 per cent of Europeans are open to buying Chinese-made vehicles, a major shift given their current 4 per cent market share. Price, design, and strong BEV technology are helping Chinese brands chip away at long-established Western dominance.

The survey also highlights the digital transformation of the buying process. More than 40 per cent of car shoppers under 45 said they would buy a vehicle online without seeing it first. And most now expect software-style updates and seamless app connectivity as standard features.

For car dealers, the findings signal both risk and opportunity. As brand loyalty weakens, customer experience, transparent pricing, and digital integration could become the defining factors in winning, and keeping, buyers.