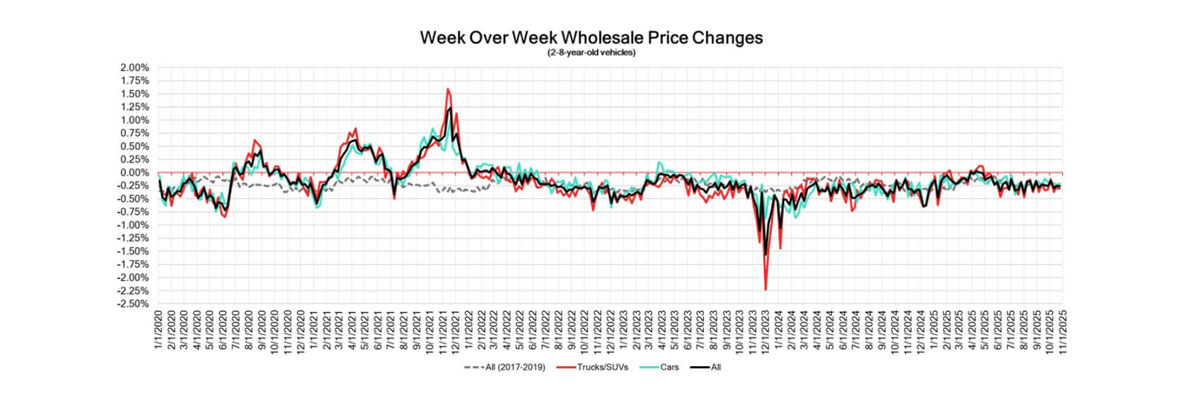

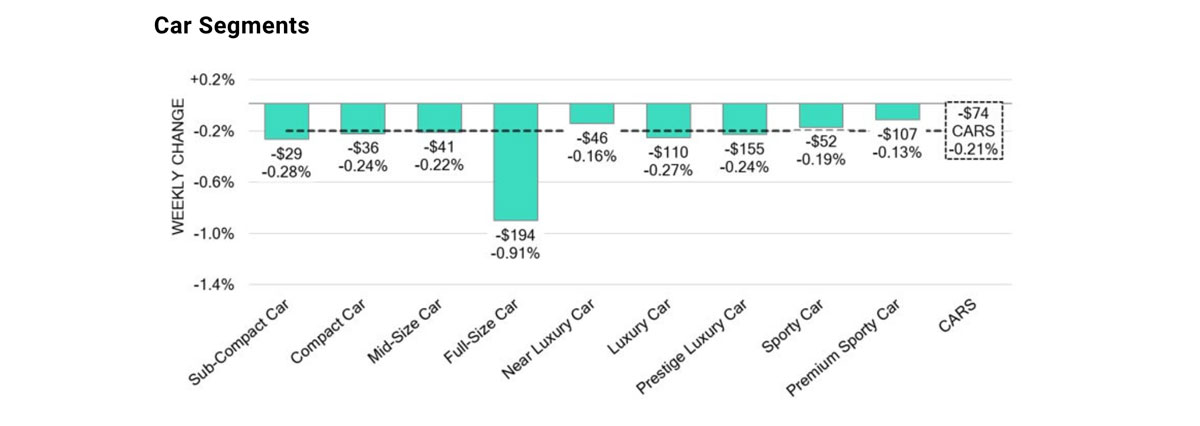

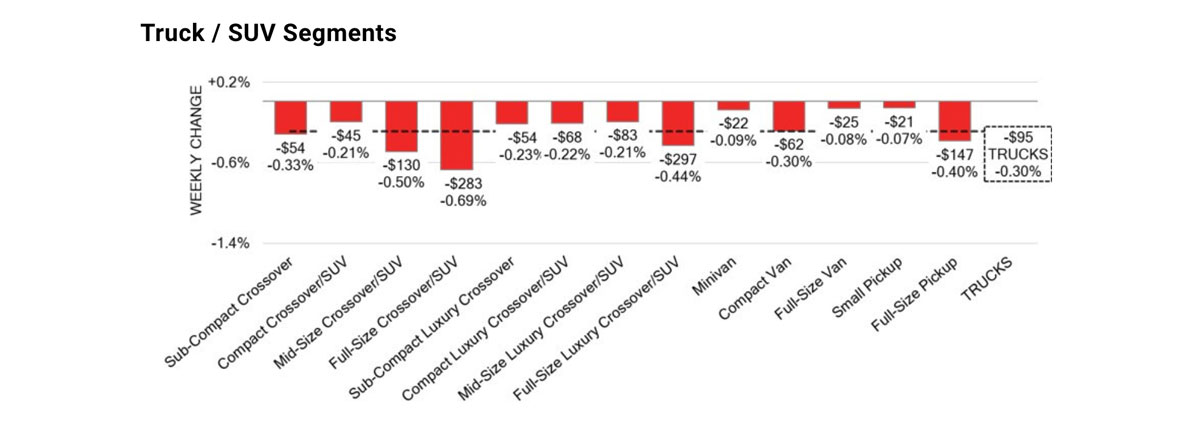

Canada’s used wholesale vehicle market posted another week of modest declines, with prices dropping -0.26 per cent for the week ending October 25 — similar to the prior week, according to Canadian Black Book. Cars fell -0.21 per cent, also similar to the previous report. And trucks and SUVs were down -0.30 per cent, which is slightly steeper than the prior week’s -0.26%.

No vehicle segment saw price gains. The largest declines came from full-size cars (-0.91%) and full-size crossovers/SUVs (-0.69%). Despite the decline, the rate of depreciation remains below the historical 2017-2019 average. (When comparing figures to the U.S. market, depreciation in the states accelerated: wholesale values for 2-8-year-old vehicles dropped 0.84%. CBB said it’s the sharpest decline since late 2023.)

At auction, sales rates fluctuated between 10% and 72.8%, averaging 29%, as buyers remained selective and sellers held firm on floor prices. Supply has normalized, but upstream channels continue to absorb much of the available inventory.

Retail listings showed mild softening, with the average used vehicle price sitting at $37,360, based on roughly 220,000 listings nationwide.

CBB also provided an economic snapshot, showing employment rose by 60,400 jobs (+0.3%), reversing the previous month’s losses. Retail sales are projected to dip 0.7% month-over-month.

In other news, Trump said he would end trade negotiations with Canada over a disputed Ontario ad on tariffs. Stellantis and GM’s plans to shift some vehicle production from Canada to the U.S. is being met with signals from Ottawa to reduce tariff-free import limits.

Trevor Longley, formerly of Nissan Canada, was appointed president of Stellantis Canada as Jeff Hines transitions to a new U.S. fleet role. Foreign Affairs Minister Anita Anand announced Canada now views China as a “strategic partner” amid tariff reviews on Chinese EVs.