October delivered a sharp pullback in the U.S. electric-vehicle market as the federal EV tax credit expired, ending three months of accelerated demand and pushing both new and used EV inventories higher, according to a Cox Automotive report.

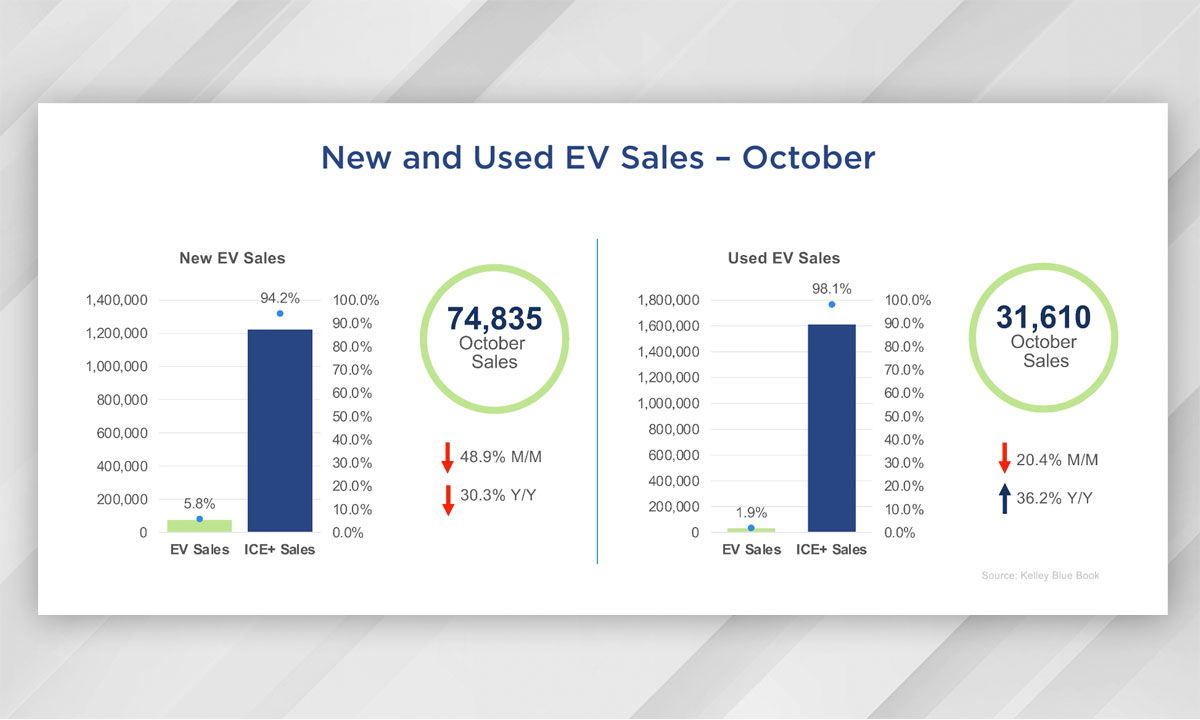

Buyers in the U.S. who rushed to secure incentives in September left a gap that quickly showed up in October sales. New EV sales fell to an estimated 74,835 units, down 48.9 per cent from September and 30.3 per cent year over year. EV market share slid to 5.8 per cent from September’s 11.6 per cent.

Declines were widespread: luxury EVs fell 39 per cent and non-luxury dropped 65 per cent. Tesla led with 40,650 units sold, down 35.3 per cent month over month, but still gained share to reach 54.3 per cent as competitors posted deeper losses. Rivian recorded the smallest decline among major brands at 14.7 per cent.

Used EV sales reached 31,610 units, down 20.4 per cent from September but still 36.2 per cent higher than a year earlier. Market share slipped to 1.9 per cent. Tesla again led the segment with 11,927 units.

Inventory levels rose as demand cooled. New EV days’ supply climbed to 79, up sharply from September’s 48-day low. GMC posted the highest supply at 91 days, while Subaru remained lean at eight days. Used EV days’ supply increased to 39, though still below ICE levels.

Prices continued to rise. The average new EV transaction price reached $59,125, up 1.6 per cent month over month. Used EV listing prices surged 8.6 per cent to $37,538, widening the gap with ICE models.

Overall, October marks the start of a recalibration period as the market adjusts to post-incentive conditions.