The days of cars and car parts flowing freely across the United States and Canadian borders without any tariffs could be coming to an end following an aggressive executive order signed by U.S. President Donald Trump.

Trump announced on Wednesday, March 26 plans to slap a 25 per cent import tariff on all cars made outside of the U.S. beginning April 3. That caused concern in the Canadian automotive industry, fearing Trump’s plans could lead to layoffs and plant shutdowns.

Trump had previously said he would impose wide-spread tariffs beginning on April 2, but specifically addressed the auto sector on Wednesday without any advanced warning.

The Canadian Automobile Dealers Association issued a statement indicating Trump’s auto tariffs “will be bad for the economies of Canada and the U.S. and bad for dealers and consumers on both sides of the border. Canada must respond, but must minimize the impact on Canadian families and businesses that need our vehicles to get to work.”

David Adams, President and CEO of the Global Automakers of Canada, said Trump’s decision was “unfortunate but maybe not entirely unexpected.”

He said the order means every manufacturer and every model built by that manufacturer will have a slightly different tariff applied based on U.S. content.

“Seems completely unworkable, but it’s worse when that is applied to parts and components,” said Adams. “Most importantly, it guts the agreement that Trump himself negotiated.”

Brian Kingston, President and CEO of the Canadian Vehicle Manufacturers’ Association, issued a statement, saying U.S. tariffs on vehicles and parts will have “immediate negative consequences” for the North American automotive industry.”

“The result is higher costs for manufacturers, price increases for consumers, and a less competitive industry,” said Kingston.

Kingston urged that all parts, components and vehicles be free of tariffs under the existing Canada-United States-Mexico Agreement (CUSMA) enacted and negotiated by Trump in his first term of office in 2018. But Trump’s executive order could change once U.S. Customs and Border Protections has a system in place to apply tariffs to non-U.S. parts.

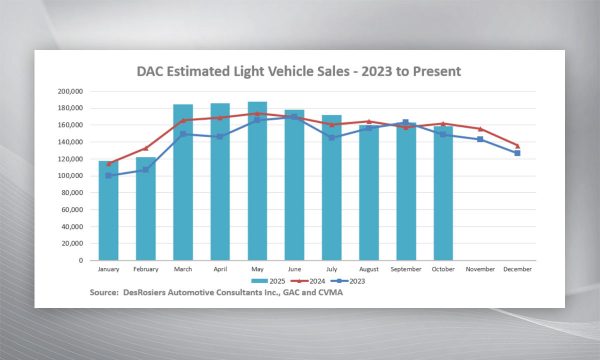

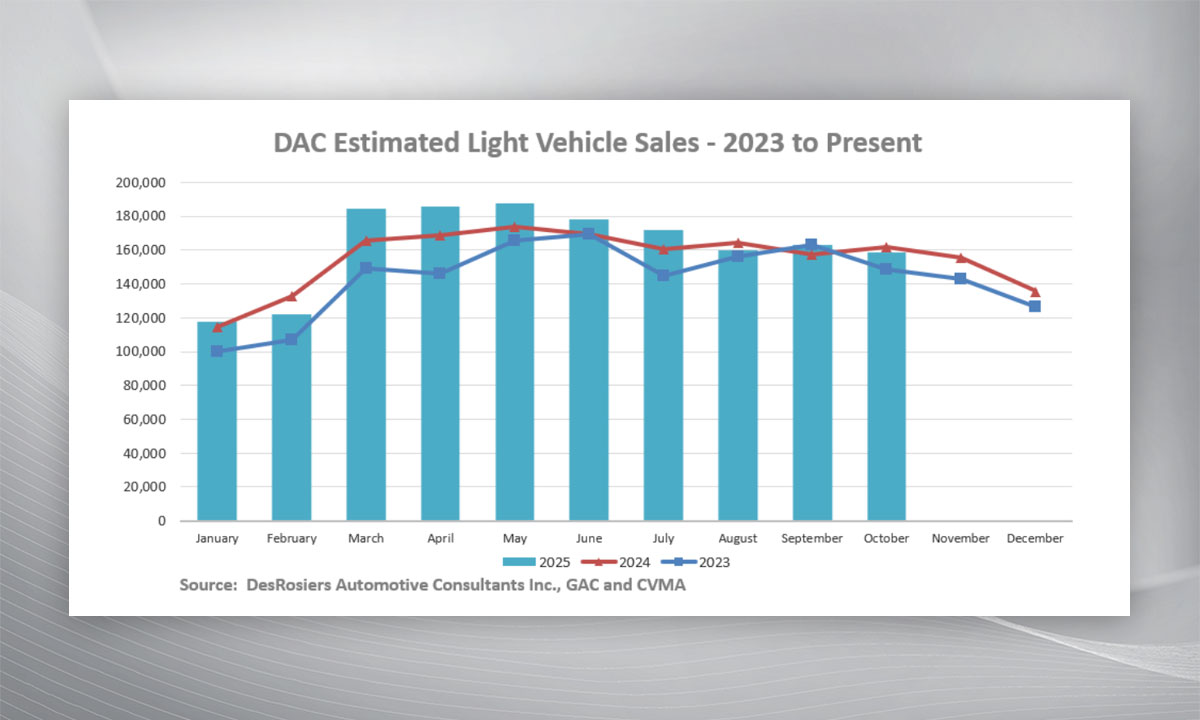

Canadian auto plants built 1.3 million vehicles in 2024, of which 1.1 million were shipped to the U.S. The Canadian automotive manufacturing business has been enjoying a resurgence in new car sales following COVID, during which a supply shortage caused delays in production and shipping. Many automakers reported record numbers in 2024. New light-duty vehicle sales in Canada rose to 1.86 million units, an 8.2 per cent increase from the 1.72 million units sold in 2023.

Trump said on Wednesday the tariff will be “the beginning of Liberation Day in America.” He added that it was “very modest” and “will continue to spur growth like you haven’t seen.” He invoked Section 232 of the Trade Expansion Act of 1962 to impose the 25 per cent tariff on imports of automobiles and certain automobile parts.

He said it is addressing a critical threat to U.S. national security, specifically action to protect America’s automobile industry that has been undermined by excessive imports threatening America’s domestic industrial base and supply chains.

The 25 percent tariff will be applied to imported passenger vehicles such as sedans, light trucks, minivans and cargo vans. It will also apply to automobile parts, including engines, transmissions, powertrain parts and electrical components with processes to expand tariffs on additional parts if necessary.

Importers of automobiles under CUSMA, which Trump negotiated in his first term, will be given the opportunity to certify their U.S. content, and systems will be implemented such that the 25 per cent tariff will only apply to the value of their non-U.S. content.

Trump indicated in his order that the U.S.-Korea Free Trade Agreement and CUSMA “have not yielded sufficient returns.”

There had been optimism from elected officials from the Canadian government and provincial premiers that discussions with members of Trump’s cabinet might create a further delay in implementing the tariffs after two previous stays, or at least create more dialogue.

“What it speaks to is it doesn’t matter how much dialogue provincial and federal officials have with (the U.S.), despite making a case that we’re a stronger industry together,” said Adams. “Tariffs are only attacks on American people and American workers. I think it undermines the President’s commitment to Americans to increased affordability and addressing inflation.”

Trump had been urged by the heads of Ford, General Motors and Stellantis not to go ahead with the tariffs as it would cripple the industry, because parts are shipped multiple times across the border. The U.S. stock markets took a significant drop when Trump first announced his tariff intent. That continued on Wednesday.

Adams said it is hard to predict how it will impact Canadian automotive manufacturing.

“From a production standpoint vehicles will still be produced, vehicles will still be sold in the United States, but it will be more expensive,” Adams said. “But that doesn’t necessarily mean that it leads to an automatic production shutdown. It might be more of a challenge if the automakers can’t get the parts necessary to produce the vehicles in Canada, but all automakers have been undertaking efforts over the course of the last number of months — probably since the President was elected, knowing tariffs were one of his commitments.”

Ontario Premier Doug Ford was less buoyant on Wednesday than he was following his recent trip to Washington, where he said meetings with U.S. Secretary of Commerce Howard Lutnick were positive. “President Trump is calling it Liberation Day. I’m saying it is Termination Day for American workers,” said Ford. He added that Trump’s early attack is “not surprising.”

Canadian Prime Minister Mark Carney met with his team on Thursday to decide what to do next. He called Trump’s move a “direct attack” on Canadian auto workers. “We will defend our workers. We will defend our companies, we will defend our country, and we will defend it together,” he said.

Hours before Trump’s announcement, Carney announced a $2 billion fund to protect the Canadian auto industry. He said it will fortify the entire Canadian auto supply chain.

Former Canadian Prime Minister Justin Trudeau announced in early March plans to slap tariffs on $155 worth of American goods, beginning with $30 billion.

Industry analyst Darren Slind, President of the Clarify Group, said the new tariffs will completely disrupt Canada’s auto sector and erode the trust in the U.S. as a trading partner.

“While the stated goal of these tariffs is to repatriate auto manufacturing to America, the costs of doing so will be enormous and will result in avoidable pain for Americans and its trading partners,” said Slind. “By contravening the USMCA free trade agreement (known as CUSMA in Canada), negotiated in good faith and proclaimed by President Trump as ‘a great deal for America,’ trust in the integrity of the United States to respect international agreements is severely damaged,” he said.

He expects in the short term we can expect to see “massive disruption” to auto production across North America, leading to lower production volumes and higher vehicle prices. He said some analysts predict vehicle price increases between $3,000 and $10,000, driving up inflation and driving down affordability. “New vehicle sales will decline, hurting the entire auto ecosystem including dealers,” he said.

Slind said in the longer term, the affordability crisis sparked by tariffs won’t result in a boost to manufacturing jobs for U.S. auto workers. “It will force OEMs located in America to automate more and more vehicle assembly to keep costs under control. When supply chains have been built over the last 60 years to optimize costs, these kinds of unnatural disruptions only lead to reduced profits and higher prices,” he said.

Sean Mactavish, CEO of Autozen, a digital platform that simplifies and streamlines the car selling process for Canadians, said he expects long-term manufacturers in Ontario will try to shift production to the U.S. He also said in the short-term there may be some temporary plant closures, depending on profitability of manufacturers such as Stellantis and Honda. And he added that it will be interesting to see how the latest tariff news plays out.

“We’ll see what sort of lobbying (Ford, GM and Stellantis) do,” said Mactavish. “I thought it was also quite interesting watching the after-hours markets move. The Big Three got hit pretty savagely.”

Mactavish said there’s a possibility Trump may waffle on his decision to implement the tariff, because he’s already done that before.

“Never say never, I think is the right approach to it,” said Mactavish. “It’s good to see that Canada is stepping up to support Canadians that will be affected. But we still need to see if and how Canada does respond to these tariffs with any reciprocal tariffs. There’s still a lot to absorb in the coming days.”