The Western Canadian Dealer Summit (WCDS) returned to the Fairmont Chateau Lake Louise this past weekend with record numbers, a sold-out tradeshow and two days of programming that kept dealers focused on the road ahead for automotive retail in Canada.

Jointly organized by the Motor Dealers Association of Alberta (MDA), the Saskatchewan Automobile Dealers Association (SADA) and the New Car Dealers Association of BC (NCDA), the Summit brought close to 400 attendees, including dealers, speakers and sponsors.

Apart from the content, social events — from a buzzing welcome reception (courtesy of First Canadian and General Bank of Canada) to a Barn Dance with live music and tons of Alberta beef served on pitchforks (courtesy of industry partners SiriusXM, iA Dealer Services and Lubrico Warranty) and a classy closing gala — gave dealers and industry partners plenty of time to reconnect against the backdrop of Lake Louise.

Conference emcee Jay Radke, who was bravely battling health issues, tied it all together, framing the weekend around three themes that surfaced in session after session: AI, cybersecurity and tightening operations, including inventory and fixed ops.

“This year’s Western Canadian Dealer Summit was our biggest and best yet,” said Gerald Wood, MDA President in an interview with Canadian auto dealer. “We had record attendance this year by a hair, a sold-out exhibit hall, and certainly the biggest event we’ve had at Lake Louise.”

Wood said the tone was set from the opening reception. “There was a buzz in the room at the welcome reception that I haven’t seen, and it’s usually quite loud,” said Wood. “The engagement through the course of the meetings has been fantastic, so we couldn’t be more excited.”

AI: powerful, present and in need of guardrails

If there was a single thread running through the agenda, it was artificial intelligence — not as a distant concept, but as a set of tools already reshaping dealership operations. At the same time, many speakers acknowledged that dealers are still searching for clear frameworks to govern AI’s use and manage the risks.

Industry veteran Charlie Vogelheim opened the event with a broader technology update, revisiting the ACES narrative: Autonomous, Connected, Electrified and Shared, and the enormous sums invested in those spaces. He noted that, while private equity and big tech have poured hundreds of billions into autonomy, connectivity and mobility concepts, OEMs themselves have been comparatively cautious.

Vogelheim walked dealers through the practical reality today: autonomous trucking pilot tests, off-road and agricultural applications, and advanced driver-assistance systems feeding into the vehicles already on their lots. He argued that the language has evolved from “connected vehicles” to software-defined vehicles, with new entrants and suppliers increasingly defining themselves around software platforms rather than hardware alone.

He then pivoted to AI, urging dealers to see it as the latest in a series of disruptive tools, a line that runs from the arrival of the PC, to Apple, to the early Internet. The message was clear: AI will create winners and losers, and dealers need to understand not only what it can do, but also the biases baked into the data that train large models.

Maddy Murray, National Director at LGM Financial Services, brought that conversation into the dealership. In her “AI is Already Here” session, she described AI as “your smartest salesperson trained on everything with instant recall,” but emphasized that it still needs human judgment and guardrails.

She pointed to real-world use cases in sales, F&I, marketing and service retention: generating ad copy, reviewing customer responses, drafting CASL-compliant emails, supporting finance office workflows and helping summarize complex data for leaders. For Murray, the priority is “adopting with intention,” using AI where it aligns with the dealership’s strategy, culture and ROI expectations, rather than chasing the latest tool because it’s fashionable.

A dealer panel on dealer operations, featuring dealers Ann Marie Clark, Andrea Ulmer, Jamie Kaban, David Hennessey and Kevin Sharfe, provided a practical counterpoint. Panellists shared examples of using AI to handle initial customer responses, mine data for service and sales opportunities, support diagnostic work in the shop and clean up legacy databases.

That dealer panel will be covered in more depth in a separate article, but one takeaway was consistent: AI can remove friction for both customers and staff, if dealerships invest in training, assign clear ownership over each tool and regularly audit what those systems are saying and doing on their behalf.

During his luncheon keynote, Pontus Riska, Global Vice President of Business Development at Keyloop, also tackled the topic of AI and offered some caution. He said dealers are excited about AI, but if they don’t have their data sorted out it won’t deliver the promise they expect. “Let’s use AI where it should be used, but let’s solve for data before solving for AI,” he said, adding that dealers and tech providers also need to focus on solving for the objectives of the dealership.

Cybersecurity, fraud and the cost of downtime

Alongside AI’s promise, there was a strong undercurrent of concern about cybersecurity and fraud, and their potential to disrupt dealership operations.

Hailey Taskey, Senior Advisor and Partner at Lloyd Sadd/Navacord, walked dealers through four major fraud scenarios she sees regularly in automotive:

- False pretense fraud, including cloned VINs and vehicles sold multiple times;

- Employee fraud, from embezzlement and unauthorized transfers to payroll and expense schemes;

- Cyber fraud and social engineering, where staff are manipulated into sending money or credentials; and

- Straw purchases, where a customer with good credit stands in for someone who cannot qualify.

“Fraud is everywhere,” she said, urging dealers to look beyond insurance coverage to the internal controls, documentation and verification processes that can prevent losses in the first place.

From BDO Canada, Alex Phan and Jeffrey Chau expanded the conversation into the broader cyber landscape. Chau, who leads cyber incident response and spends much of his time trying to “break in” to client systems as part of proactive testing, reminded the room that cybercrime today is highly professionalized. Attackers buy and sell data — from email addresses to credit card details and social insurance numbers — and use it to assemble detailed profiles that increase the value of each breach.

Phan highlighted the double-edged nature of cloud and SaaS tools: powerful, scalable and increasingly central to dealership operations, but also attractive gateways if not configured and monitored correctly. The pair stressed that dealerships hold exactly the kind of rich data sets criminals want, and that the costs of an incident go well beyond ransom payments, including operational downtime, reputational damage and regulatory exposure.

Their advice centred on fundamentals: multi-factor authentication, clear access controls, patch management, tested incident response plans and regular staff training to recognize phishing and social engineering attempts.

The underlying message was simple: as dealers become more reliant on digital tools and data, cyber resilience has to be treated as a core operational priority, not a side project for the IT vendor.

Operational discipline, particularly around inventory and fixed operations, formed another major theme of the event.

Jasen Rice, Founder and CEO of Lotpop, challenged dealers to rethink how they align inventory management with lead management. Too often, he said, “fresh leads” absorb staff attention while older opportunities are ignored, even though the age of the lead has little to do with where the customer sits in their buying journey.

Rice noted that at many stores, 60–70 per cent of digital leads are tied to vehicles that are no longer in stock. Rather than defaulting to price drops to move aged units, he encouraged dealers to “focus on your stuff first”: identify which vehicles are no longer profitable, use bucket management to monitor problem units and look for switch opportunities within the same segment. Managing the inventory cycle, rather than the inbox, was his key point.

A fixed operations panel, moderated by Sebrina Westbrooke of the Automotive Business School of Canada, dug into customer experience, technician capacity and the realities of modern vehicles.

Panellists also talked candidly about the technician shortage, the limitations of traditional flat-rate pay when work becomes more complex and the need to rethink compensation, training and culture to attract and retain the next generation of techs. Look for a full story on that fixed ops panel to appear in an upcoming e-news.

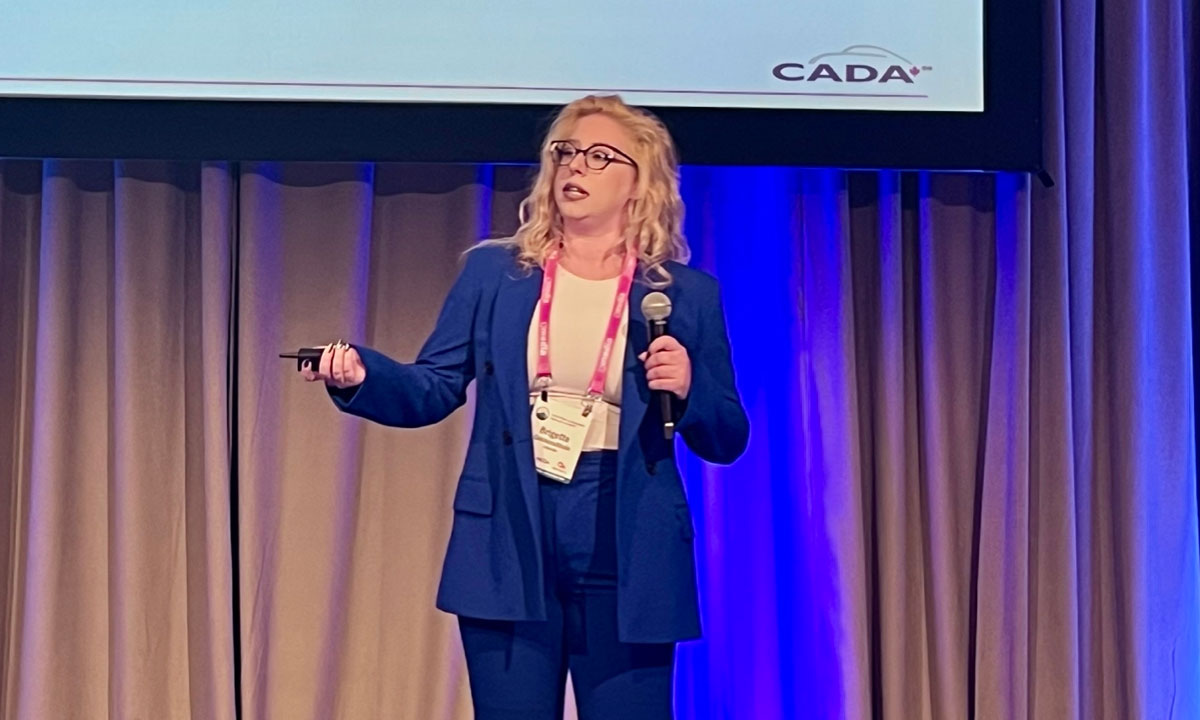

A session on the CADA Workforce study, led by Brigette Goldenshtein, CADA’s Manager of Marketing and Communications, highlighted national labour trends and the high cost of vacant skilled positions, particularly in the shop, where extended vacancies can translate into hundreds of thousands of dollars in lost revenue and long-term reputational damage.

Goldenshtein took dealers through findings from the 2025 CADA Workforce Study, and flagged several key issues they need to consider such as retention and recruitment, particularly for Gen Z employees who have high turnover rates. She encouraged dealers to take part in the 2026 study, and promoted the new online portal that participants will be able to access to analyze data pertinent to their dealership.

Darren Slind, Co-Founder and President of the Clarify Group, presented an overview of CADA’s Canada Automotive Retail Technology Study (CARTS). The CARTS findings reinforced what many dealers already feel: tech stacks are crowded, AI adoption is uneven, and success often comes down to implementation, training and governance rather than the tools themselves. You can read a full article on that session here.

Several sessions drilled into how consumer behaviour is shifting online, and what that means for dealership marketing and digital retailing.

Mathew “Growdy” Growden drew on his years with Google and his work as an educator and consultant to highlight the growing role of dealership websites, AI-assisted research and non-traditional purchase paths. His research showed that a meaningful share of buyers are doing fewer test drives, visiting fewer stores, and in some cases purchasing without visiting a physical dealership at all. Growden even resisted his infamous overuse of “f-bombs” and only let one slip during his presentation, setting a new personal best in the process.

During her presentation, Google Canada’s Breanne Schroder added that about 43 per cent of Canadian car buyers are already using AI tools to support their research, and that those customers often stay undecided longer and visit more dealers before making a decision.

For auto retailers, this means more touchpoints and more chances to influence the outcome, but only if their websites, listings and ad campaigns are set up to capture and act on those signals.

From X (formerly Twitter), Jeremy Reisler positioned the platform as a place where dealers can reach a premium, highly-engaged audience. With AI search tools like Grok now embedded into the experience, he encouraged dealers to experiment with campaign creation, contextual placements around sports and entertainment content, and more active participation in comment threads and conversations.

His core advice: treat X as a test-and-learn environment, rather than waiting for agencies or OEMs to define the playbook.

For many in the room, these sessions reinforced a broader theme: digital demand generation is fragmenting, and dealers will need to be visible and responsive across multiple channels, search, social, AI assistants and their own websites, if they want to stay top of mind.

The event also offered sessions designed for broader reflection. Entrepreneur and philanthropist W. Brett Wilson delivered the closing keynote with candid stories about partners, principles and priorities, while motivational speaker Alvin Law and U.S. dealer innovator Brian Benstock added energy and urgency to the conversation about change.

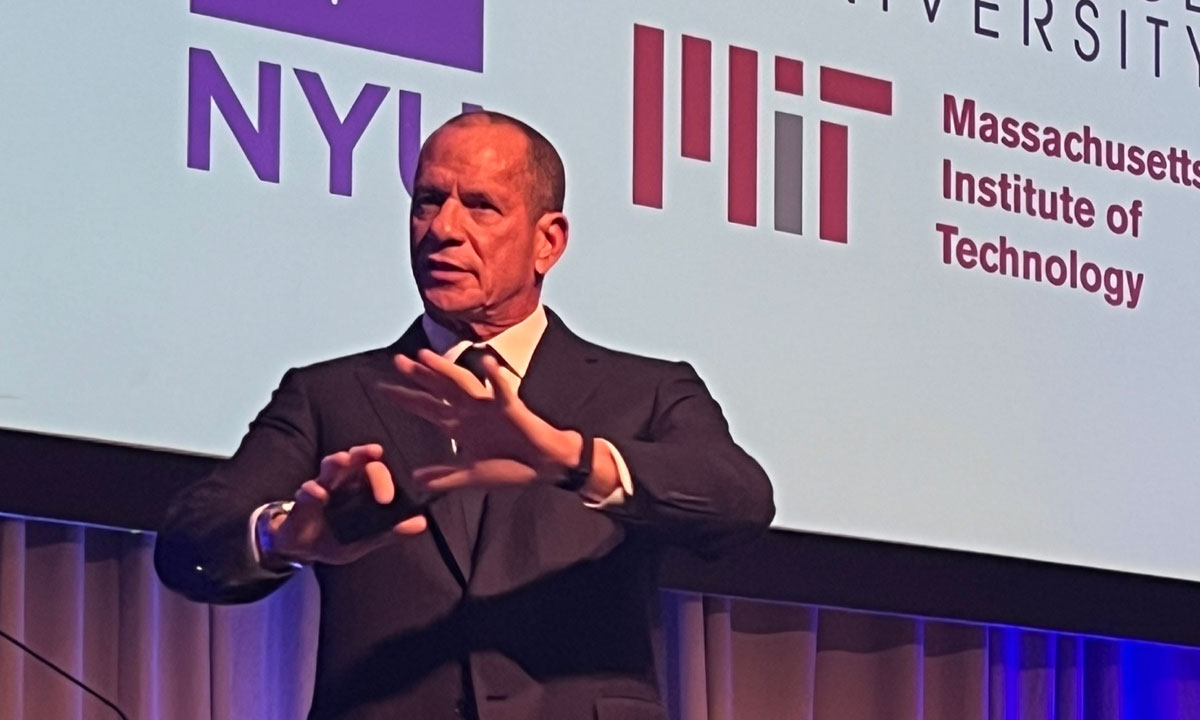

Benstock, in particular, challenged dealers to think differently about service, e-commerce and AI, sharing how his Paragon Honda and Acura stores have leveraged data, extended hours and pickup-and-delivery models to find what he described as “acres of diamonds” under their feet within their existing customer base.

On the advocacy side, CADA’s leaders were active participants. Tim Reuss, CADA’s President and CEO, held a closed-door dealers-only breakfast briefing at the start of the event on Friday morning.

On Saturday, Huw Williams, CADA’s Public Affairs lead, and Charles Bernard, Chief Economist, took the stage to connect the dots between policy debates in Ottawa, national economic trends and the pressures on dealer profitability and investment. Topics ranged from EV mandates and tariffs to the federal luxury tax and long-term competitiveness.

For Alberta dealer and former CADA Chair Paul Williams, the real value of the Summit was stepping back from daily operations to absorb where the industry is heading. “The venue’s spectacular,” he said. “I don’t think any western dealer could complain about the views and the facilities.”

What struck him most was how quickly the conversation has shifted across conferences. “I’m really enjoying how the conversation is evolving — a lot of discussion on AI, and I’m watching cybersecurity as well,” said Williams. He added that sessions felt interconnected this year, pointing to broader change rather than isolated issues. “We’re at another evolution of the auto industry… from the dealer network standpoint, we’re at a new evolution right here.”

Williams said events like this help dealers make sense of the sheer volume of tools, risks and ideas coming at them. “There’s a lot of software coming all at once,” he said. And while not every dealer will walk away an expert, he appreciated having space to compare notes and flag the next set of challenges. “It’s great to see this, we’re identifying where that next hurdle is and how we’re going to get around it.”

The suppliers and exhibitors Canadian auto dealer spoke with were also pleased with the attendance, content and energy at the event. They helped underwrite significant costs with sponsored receptions, dinners and social events. Visit here to review the full list of sponsors.

“Dealers are clearly trying to simplify their tech stacks and get more value from what they already have,” said Sebastiaan Roovers, Vice President Sales, Americas for Keyloop, one of the event’s sponsors in an interview. “For us, it’s invaluable to hear directly where the friction points are and to talk about how we can help remove them.”

Keyloop also held a private reception for dealers prior to the event’s closing gala where they demonstrated their Fusion platform, which they say offers a more unified approach to managing dealership tech stacks. Dealers gathered around large screens in a scenic ballroom as Keyloop team members provided live demos of the platform’s capabilities.

As the last guests filtered out of the gala and the lights dimmed over Lake Louise, attention was already turning to Banff 2026, where the next event will be held.