U.S. new-vehicle sales are expected to ease in November as higher prices and waning electric-vehicle demand temper what had been a strong stretch for the market.

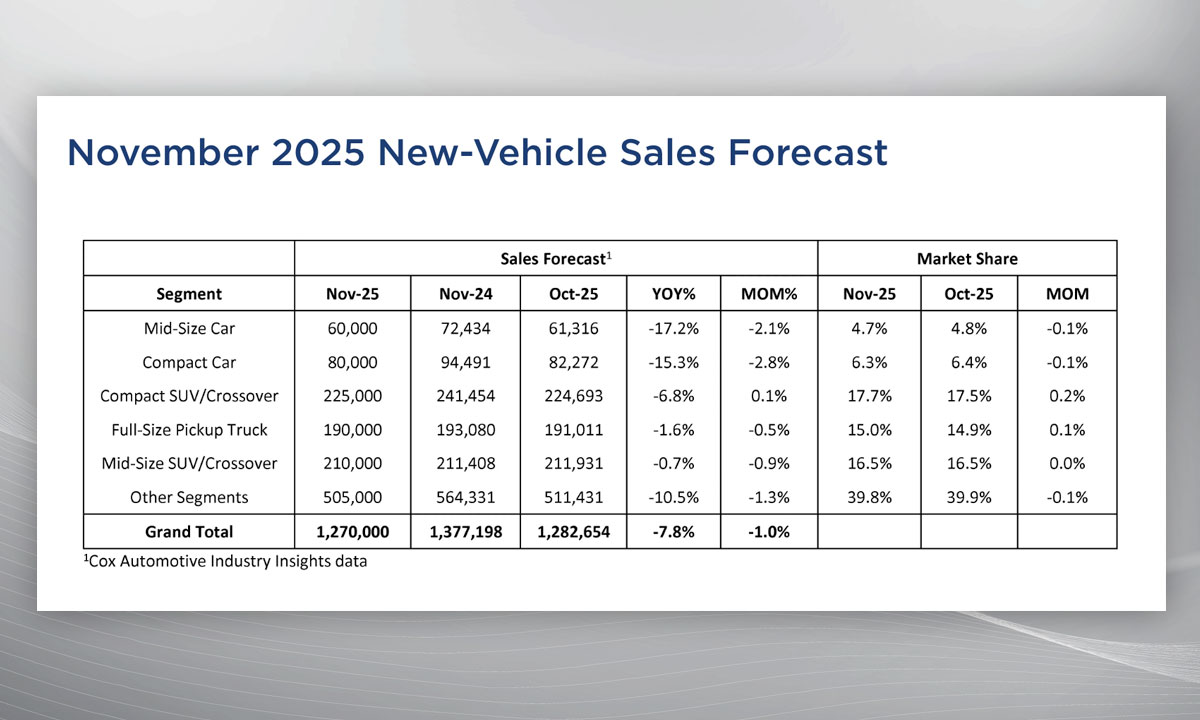

Cox Automotive projects a seasonally adjusted annual rate of 15.7 million, slightly ahead of October but below last year’s 16.5 million. Sales volume is forecast to reach 1.27 million units, down 1 per cent from October and nearly 8 per cent year over year. Fewer selling days (25 this month) account for part of the decline.

“The new-vehicle sales pace had been expected to slow in the fourth quarter, and that’s what we are seeing,” said Charlie Chesbrough, Senior Economist at Cox Automotive, in a statement. “The headwinds from higher prices and fewer government subsidies for electric vehicles are finally slowing the market after a surprisingly strong previous six months.”

Chesbrough added that sales started to surge in the spring as consumers rushed to market to beat what they anticipated would inevitably be higher prices in the wake of announced tariffs. “Now, with more tariffed products replacing existing non-tariffed inventory, prices are drifting higher, leading to slower sales which may last through the remainder of the year and into next year.”

Cox Automotive said the recent pullback in EV demand is playing a central role. After three strong months, October saw a sharp reversal as the federal EV tax credit expired.

“Sales of EVs and PHEVs accelerated in the wake of the Big Beautiful Bill’s passage in early July as buyers rushed to market before the $7,500 tax credits expired at the end of September,” said Chesbrough. “Q3 was the strongest quarter ever for EVs; however, Q4 is a different story. Sales of EVs and plug-in hybrids are now collapsing after tax credits expired.”

Falling EV volumes have pushed average transaction prices lower, with Cox Automotive expecting softer EV demand to carry into early 2026.