The U.S. auto industry closed 2025 with better-than-expected results, despite operating in a year shaped by economic uncertainty, policy shifts and uneven consumer confidence. Retail sales outperformed forecasts, fleet demand held up and wholesale values stayed relatively stable, even amid tariff-related volatility. That resilience, however, masks a market increasingly pulled in different directions.

Heading into 2026, fragmentation is becoming the defining theme. According to Cox Automotive’s economic outlook, five forces are set to shape the year ahead, creating both opportunities and risks for dealers. The first is the bifurcated consumer.

Higher-income households are benefiting from wealth effects, tax relief and lower interest rates, while lower-income buyers remain stretched after years of inflation. The result is accelerated trade-down behaviour, with stronger demand for affordable vehicles, lower payments and used options.

Labour dynamics are also shifting. The economy is growing, but employment has stalled in what Cox Automotive described as a “jobless expansion.” Slow job growth is expected to weigh on first-time buyers and entry-level demand.

Inflation appears to be easing, and rate cuts should improve affordability, but uncertainty around long-term rates and Federal Reserve leadership continues to cloud the outlook. Data shows policy risk remains elevated as well, particularly with looming CUSMA renegotiations and the next phase of the electric vehicle market, where incentives fade and off-lease EV supply grows.

Technology is the final wildcard. AI-driven investment is supporting GDP growth and consumer wealth, while promising productivity gains across retailing, even as competitive pressure increases.

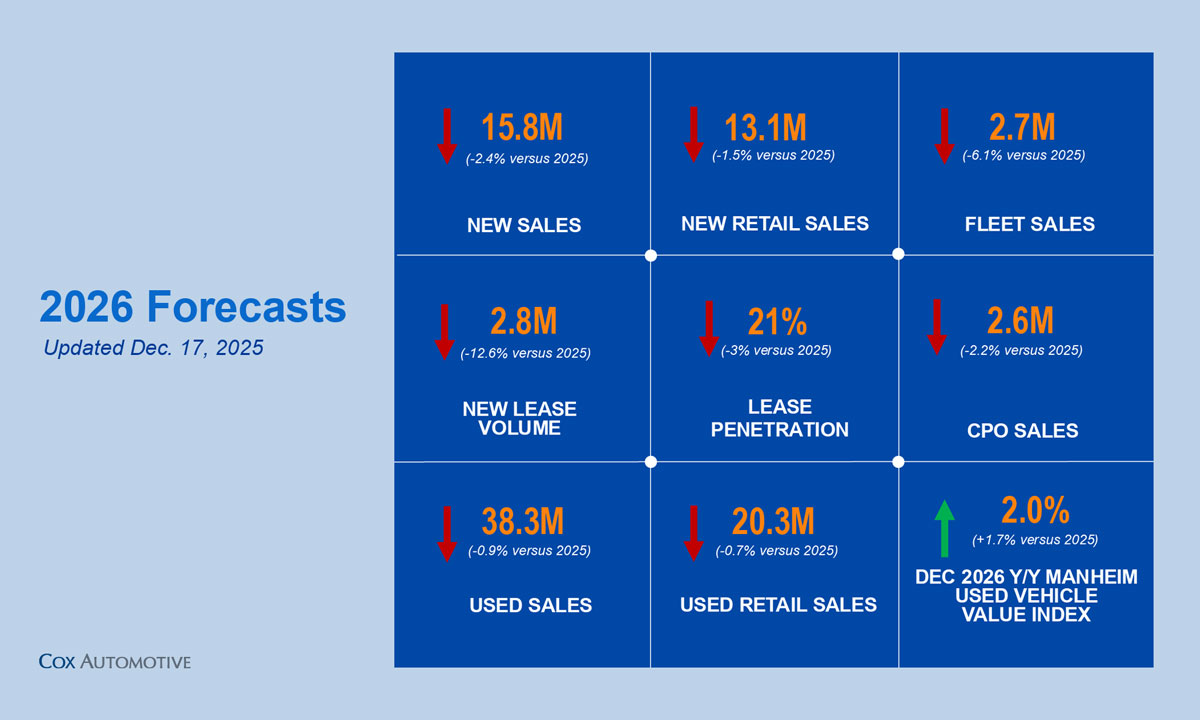

For 2026, Cox Automotive forecasts U.S. new vehicle sales at a SAAR of 15.8 million, down 2.4 per cent year over year. Used sales are expected to dip about 1 per cent, while wholesale values are projected to rise 2 per cent, signalling more normal depreciation. The overall takeaway for dealers may be that a slower, more uneven market puts a premium on inventory discipline, pricing accuracy and understanding which customers are still in a position to buy — and which need lower-cost solutions.