OEMs might have different priorities, but research shows consumers remain keen on attending

Samuel Clemens, more commonly known by his pen name, Mark Twain, has many famous quotes attributed to him — some real, some fabricated.

One of his many humorous quips transpired when he allegedly sent a telegram to a newspaper that had prematurely published his obituary that read: “The reports of my death are greatly exaggerated.”

Such is the case with the modern auto show, it seems. Many have inaccurately reported upon their collective demise, but there are a number of critical and compelling reasons to support that they are alive and well.

New marketing strategies and tightening budgets may have taken a bite into what exhibitors are willing to spend, but data supports that there is still a great deal of value in manufacturers being present and top of mind.

The Clarify Group has managed the Visitor Experience Survey for the Canadian International AutoShow for the third year in a row. We have also subsequently been commissioned by the Montreal International Auto Show and Vancouver’s rebranded Elevate show to manage their respective surveys, meaning we now manage the data and insights for the leading auto shows in the country.

Among these three shows, we have gained valuable insights from over 10,000 visitors that provide us with a very clear, current and robust picture of the opinions and purchase considerations of the Canadian automotive consumer.

First and foremost, attendance at major shows remains strong. Kicking off the Canadian auto show calendar, over 163,000 people visited the Palais des Congres during the Montreal Auto Show.

Record-breaking snowstorms had a negative impact on the Show in Toronto this year, but 323,521 people still passed through the doors of the Metro Toronto Convention Centre over 10 days.

The Elevate show drew 138,773 people to the Vancouver Convention Centre over five days — resulting in the second consecutive year of record breaking attendance. Those are big numbers. What is even more compelling are the sentiments and insights we retrieved from the post-show surveys.

Once again contradicting a common sentiment, that young people don’t engage in activities outside of the digital sphere and don’t care about cars, the survey results prove otherwise.

The most enthusiastic advocates for the show were between 20-29 years-old, with female respondents much more likely to recommend the show than in previous years. Connecting the dots, this means that shows are attracting the attention of a new batch of consumers who are or will be in-market for a vehicle.

Even better, they are visiting these shows to gather information to make purchasing decisions.

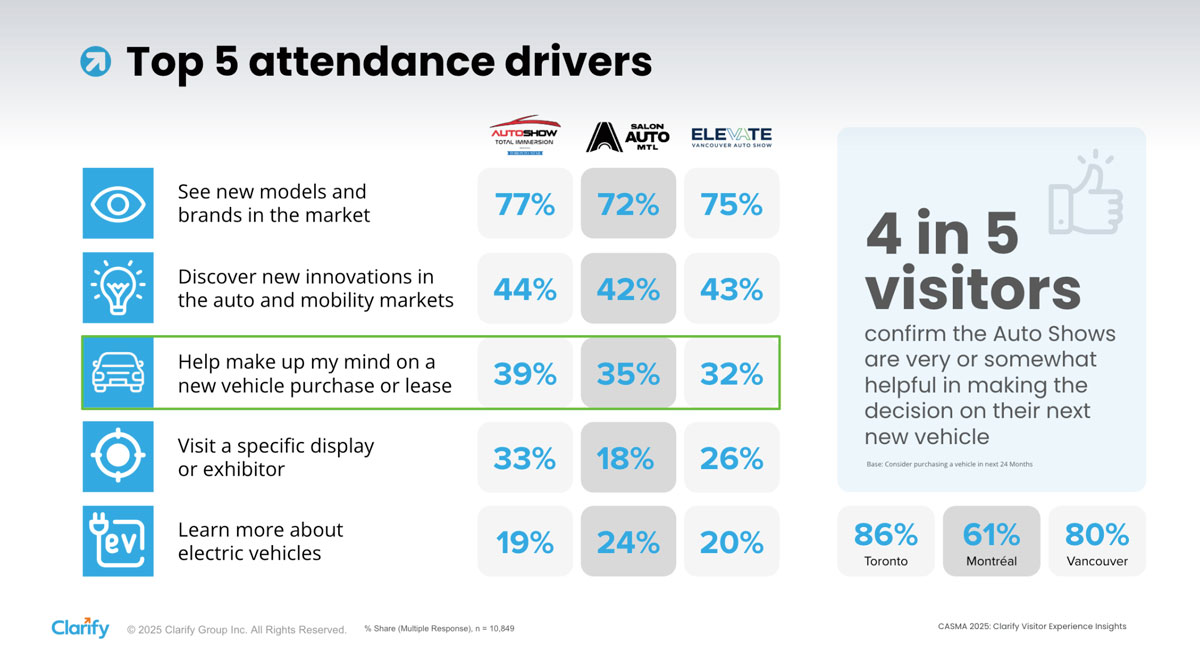

More than three in four visitors (77 per cent) come to the show to see new vehicles and brands in the market, while nearly two in five visitors (39 per cent) attend to help them make up their mind on the purchase or lease of a new vehicle.

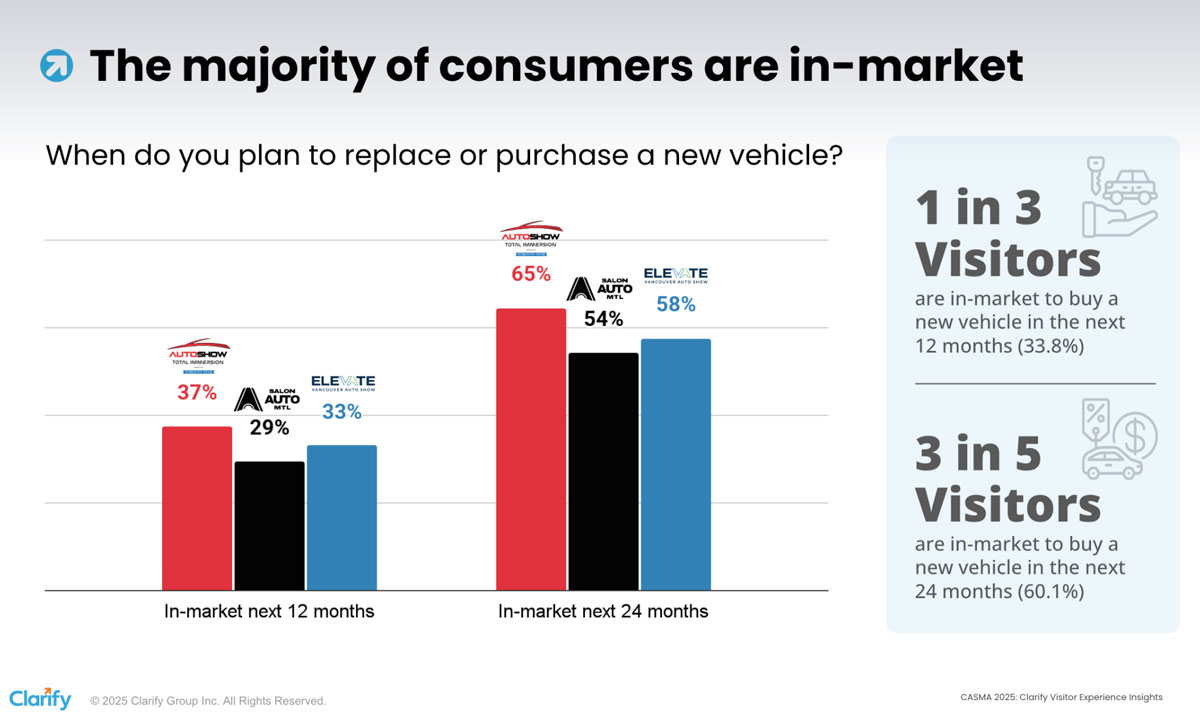

More than 85 per cent of visitors agree that auto shows are somewhat or very helpful in supporting their new vehicle choice, with nearly two in three visitors (65 per cent) intending to purchase or lease a new vehicle within 24 months. Not only that, nearly two in five visitors (37 per cent) are in-market now, with the intent to purchase in the next 12 months.

Attending an auto show is a catalyst for action that benefits OEMs and dealers alike. Not only are show visitors attending with the intention of making future purchasing decisions, but they are also taking the next steps in the process.

Over half of all visitors have or will soon go online to learn more (53 per cent), and over one in three will visit a dealership (35 per cent), and one in four arrange a test drive (25 per cent).

Predictably, the frequency of these path-to-purchase behaviours increases dramatically among in-market visitors, both 12- and 24-month intenders.

More than half (54 per cent) of respondents who identified as being in-market said they would be visiting a dealer in the next 12 months, while 40 per cent said they would be exploring a test drive.

More than a quarter (27 per cent) said they have or will order a new vehicle as a result of attending the auto show. The further down the path of their purchasing journey, the more likely they are to test drive and purchase as a direct result of their auto show experience.

While many visitors come to the show with a particular brand, or brands, already on their consideration list, auto shows provide the opportunity to add or remove brands from this list.

Among in-market visitors, meaning that they intend to purchase within the next 12 months, exhibiting brands generate 2.2 times the rate of consideration uplift compared to the average for all brands. Non-exhibiting brands are particularly vulnerable, as the data supports that their absence directly correlates to a drop in consideration, by as much as 2.7 times.

These non-exhibiting brands create unnecessary risk by allowing their owners to engage with key competitors and by failing to engage with competitive owners. Out of sight, out of mind. Nearly half of all visitors (49 per cent) added at least one brand to their consideration set after visiting the auto show.

So, contrary to what some naysayers may opine, the concept of the in-person auto show is still very much a worthy part of the car-buying process for Canadian consumers. Visiting a show allows them to learn about and even experience new products firsthand, refine their consideration set, and help them on their journey to make more informed purchasing decisions.