Prices for the Canadian used vehicle wholesale market remained relatively flat during the past week, which ended on February 4, based on Canadian Black Book’s latest weekly automotive update.

Prices for the car segment increased slightly (+0.17%), while the truck/SUV segment experienced a slight decline (-0.11%). In the United States, the overall car and truck/SUV segments were down for the seventh consecutive week—this time at -0.49%. Overall, the Canadian market was up 0.03% for the week, compared to 0.01% the previous week and -0.28% for the 2017-2019 average.

“The Canadian wholesale market has continued to remain stable overall. Newer vehicles tend to be outperforming vehicles aged three years and older,” said CBB. “Supply remains low, while demand continues to weaken on both sides of the border.”

The increase for the car segments represents the third consecutive week that prices were slightly up. Luxury cars had the largest price increase for the week (+1.07%), followed by mid-size cars (+0.62%) and sub-compact car (+0.45%).

On the down side, full-size cars experienced the largest price decline (-0.63%), followed by prestige luxury cars (-0.48%) and premium sports cars (-0.24%).

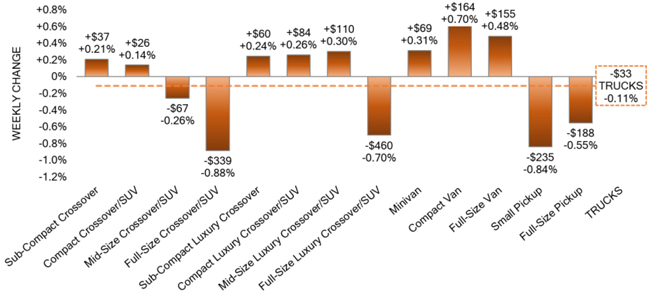

Within the trucks/SUV segment, for the second straight week compact vans managed the largest price increase (+0.70%), followed by full-size vans (+0.48%) and minivans (+0.31%).

On the other end, full-size crossovers/SUVs experienced the largest price decline for the week (-0.88%), followed by small pickup trucks (-0.84%) and full-size luxury crossovers/SUVs (-0.70%).

As for the average listing price for used vehicles, CBB said that figure continues to reach historic highs week-over-week, with the 14-day moving average now hovering around $34,000. The analysis is based on approximately 120,000 vehicles listed for sale on Canadian dealer lots.

In other news, the unemployment rate in Canada increased 0.5 percentage points to 6.5% in January, which CBB said is the first increase since April 2021. Employment was down 200,000 jobs in January, thanks largely to restrictions caused by the fifth wave of the COVID-19 pandemic.