The number of used vehicles sold per dealer in 2020, on average, declined by 204 in 2019 to 172 vehicles last year, representing a decline of 15.8%, according to DesRosiers Automotive Consultants (DAC). However, a rebound is anticipated.

The number of used vehicles sold per dealer in 2020, on average, declined by 204 in 2019 to 172 vehicles last year, representing a decline of 15.8%, according to DesRosiers Automotive Consultants (DAC). However, a rebound is anticipated.

The comments stem from a survey that includes more than 650 Used Car Dealers Association (UCDA) members, both independent used car dealers and the used car operations of franchised new car dealers. These dealers were surveyed as part of a collaboration between DAC and its friends and colleagues at the UCDA, on the impacts of the pandemic on the used vehicle sales market.

“When asked about their expected sales for 2021, used car dealers overall indicated a 17.1% recovery to 201 units on average — very close to 2019 levels,” said DAC.

In the survey, franchised new car dealers said they expect sharper sales growth in 2021, with sales rising 10.9% above 2019 levels. However, Independent dealers expect 2021 sales to remain below 2019 levels — from 165 units in 2019 to 147 units in 2021, “despite a recovery of 15.9% relative to 2020,” said DAC.

“The used car market is a complex system involving consumer trade-ins, fleet vehicles, and significant flows of product to the United States,” said Andrew King, Managing Partner at DAC. “How these various moving parts will interact as vaccination programs progress and the economy reopens remains to be seen, but the outlook appears positive.”

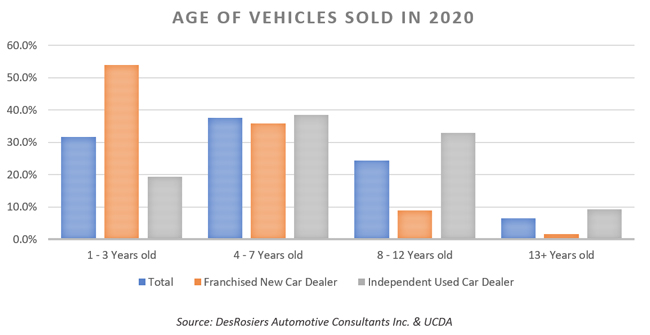

Dealers were also asked about the age of the vehicles they sold last year; franchised new car dealers were more focused on younger vehicles, between one- to three-years-old. That grouping made up 53.9% of their sales. In comparison, independents focused more on four- to seven-year-old vehicles. DAC said this category was the largest group at 38.5%, although “significant sales volume” was also observed in younger and older vehicles.

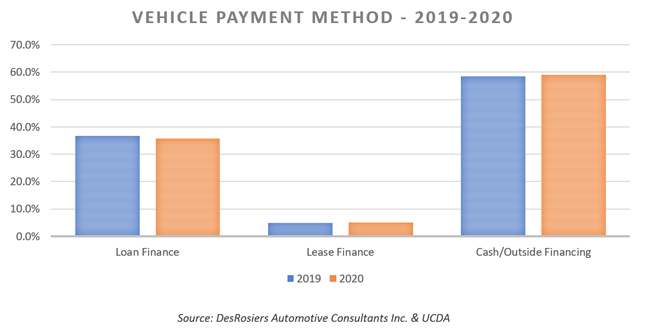

“Amongst the disruption of 2020 as a whole, one measure of stability that was evident was the methods by which customers finance their used vehicles,” said DAC. “The breakdown between loans, leases, and cash/outside financing remained stable between 2019 and 2020; variance remained under a single percentage point across all three categories.”