Why aren’t small-car sales soaring?

Gasoline prices have been rising steadily since last September. As this is written, Regular gasoline is running in the range of $1.28/litre in the Toronto area and if the current rate of increase continues, prices will top 2008’s peak of $1.40/litre by June.

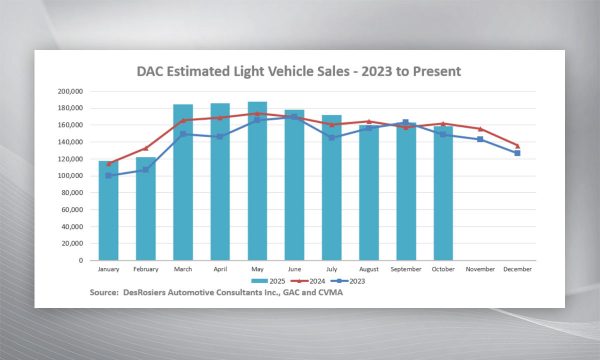

Traditionally, increases in gasoline prices have triggered an immediate corresponding increase in the sales of more fuel-efficient entry-level vehicles. That relationship is not exactly propor- tional, but the trend is undeniable, as shown in the accompanying graph depicting gasoline prices and entry-level vehicle sales over the past five years.

Whenever gasoline prices increased sharply, entry-level sales jumped as well. Until now.

As would be expected, there was an initial bump in sales of those fuel-efficient vehicles when gasoline prices began to rise in October. But then, unexpect- edly, their sales nose-dived and have continued to do so – while gasoline prices just kept on climbing.

Improbably, it’s truck sales that are on a ram- page in Canada. The truck share of the market hit a record high of 62.0 percent in January and has fallen back only slightly since then. Year-to-date, through March, trucks account for 57.9 percent of all new-vehicle sales.

Looking more closely at segmentation, sales of compact and sub-compact cars through February 2011 fell by 6.4 percent from the same period last year, in an overall market that was down just 0.7 percent. In contrast, full-size pickup sales were up by 7.2 percent over that period.

So what’s going on? Why aren’t Canadian consumers responding to high gasoline prices as they have in the past?

Incentives distort the natural order

According to auto-industry analyst Dennis DesRosiers, deep discounts and incentives for larger vehicles explain much of this reversal in fortune for entry- level vehicles. Start-

ing last fall, there was an average incentive above $10,000, and for some vehicles closer to $20,000, DesRosiers explains. And most of that incentive money was on large pickup trucks and SUVs.

As a result, DesRosiers concludes, “What the consumer basically said was… ‘if a vehicle company is stupid enough to give me $15,000 to buy a new vehicle, then I don’t care about gas prices. I’ll take the incentive and buy the larger less fuel-efficient vehicle!’ A consumer can buy a lot of gas when a vehicle company puts $15,000 in the glove box of their vehicle.” It’s a valid argument, and it probably does account to a large extent for the surge in full- size pickup truck sales. But it’s highly unlikely that potential small-car buyers are opting instead for big pickups, the big money on the hood notwithstanding.

There must be other factors at play as well.

Other influences

It’s not that people don’t care about fuel econ- omy. In a survey recently conducted for the AutomobileJournalists Association of Canada (AJAC), which involved approximately 3,000 new-vehicle shoppers, fuel economy ranked right behind price and safety among the factors they considered most important in their buying decisions.

I suggest that, beyond just the impact of incentives, three other factors also come into play in the shift away from entry-level cars.

One is the fact that fuel consumption in almost all vehicles has dramatically improved in recent years. Another is the ongoing shift from passenger cars to CUV/SUVs, of which the most popular models offer fuel consump- tion not much higher than that of compact cars. And a third is the platform age of many traditionally high-selling compact cars – specifically the Honda Civic, Toyota Corolla and Mazda3, all of which are selling at rates well below a year ago.

In contrast, the new Chevrolet Cruze, Hyun- dai Elantra and Volkswagen Jetta are selling at record rates. It will be interesting to see how the picture changes as the new Accent and Civic become widely available. Stay tuned.