Tariffs, counter-tariffs and shifting sourcing patterns out of Washington helped define Canada’s auto market in 2025. It also left many dealers feeling like the industry spent the year bracing for the next shoe to drop.

As DesRosiers Automotive Consultants (DAC) put it in its year-end 2024 release: “Looking forward to 2025 we can but hope that the market equilibrium hangs around a while and we don’t see a return of (a different type of) chaos.” It’s been a year since that statement was released. Now, DAC says the chaos has arrived.

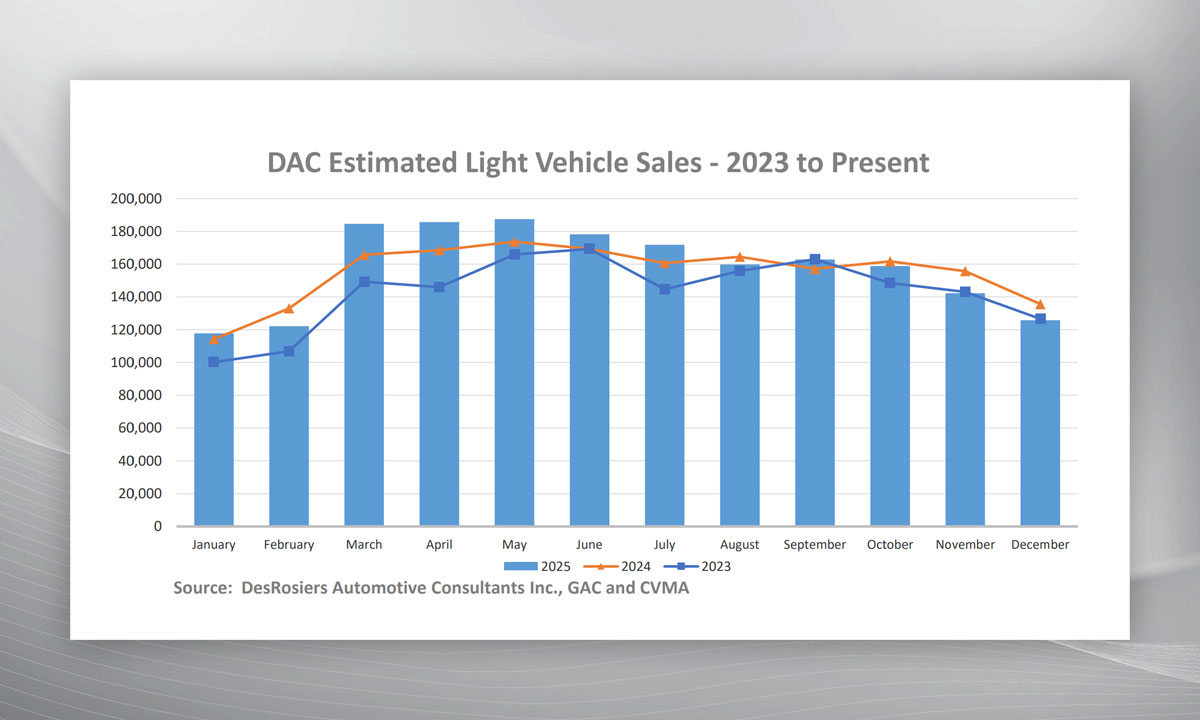

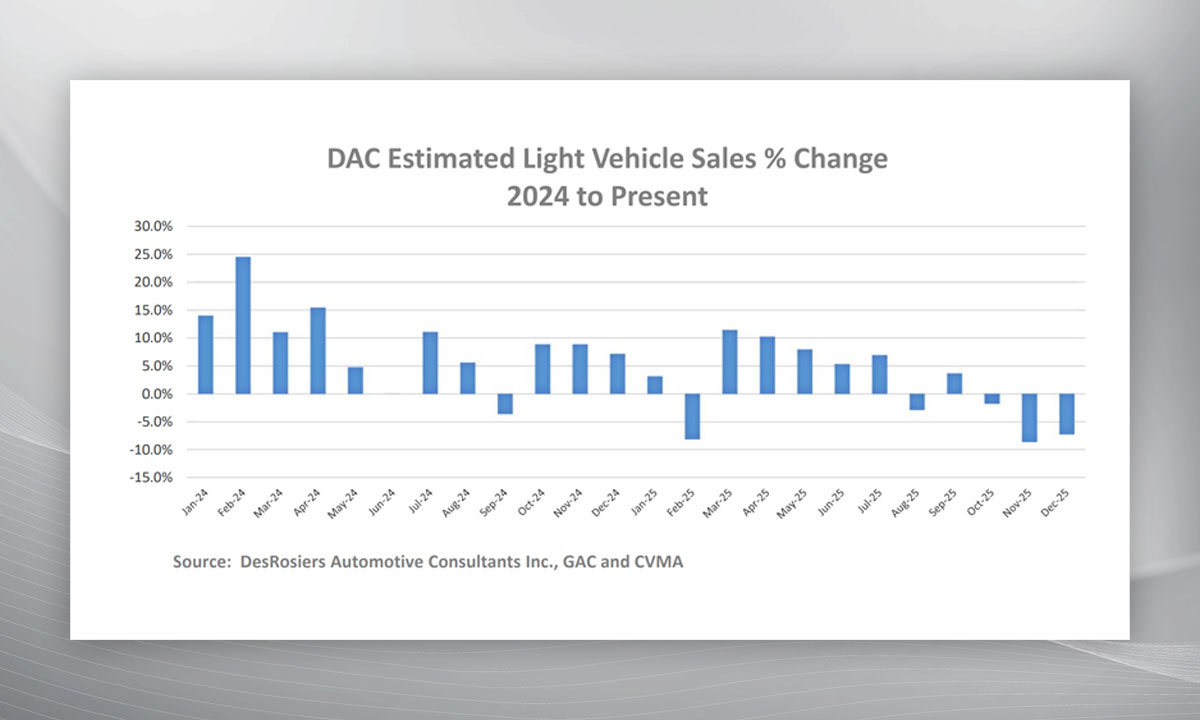

December 2025 sales are estimated at 126,000 units, down 7.3 per cent from December 2024 despite one extra selling day, according to DAC. The comparison was difficult: December 2024 was unusually strong, boosted by Quebec consumers rushing to buy ZEVs before incentive changes. The seasonally adjusted annual rate (SAAR) for December 2025 was 1.92 million, in the middle of the year’s range.

For the full year, the Canadian market is estimated to have reached 1.90 million units, up 2.0 per cent year-over-year and the best result since 2019’s 1.93 million, according to DAC. Still, the market remains 7.1 per cent below the 2017 peak, even as Canada’s population has increased by 4.9 million since then.

“We will never complain at a market that grows from the previous year; however, this year our celebrations are decidedly muted. The market remains 7.1 per cent below the previous peak of 2017 — and it should be noted that since that time the Canadian population has grown by 4.9 million people — making what we term at DAC the real ‘gap to growth’ much worse,” said Andrew King, managing partner of DAC, in a statement.

DAC’s early take on 2025 points to a year where policy shocks directly affected inventory mix, sourcing decisions and ZEV demand, and suggests 2026 could bring more pressure on pricing and margins as OEMs keep reworking supply lines.

In terms of OEM brands, GM finished 2025 as market leader with just under 300,000 units, fewer than 6,000 ahead of Ford. Mazda posted the biggest volume-brand percentage gain at 13.2 per cent, while MINI led luxury brands with a 22.2 per cent increase. Tesla saw volumes fall more than 60 per cent, though DAC noted recent recovery tied to German-built Model Y imports arriving in Halifax and Vancouver.

Several brands posted record sales in 2025, including Audi, Hyundai, Toyota, Volkswagen and Volvo.