For the first time, DesRosiers Automotive Consultants (DAC) has produced a clear profile of the used vehicles that moved from Canada into the United States in 2024. This includes volumes, brand distribution and vehicle age.

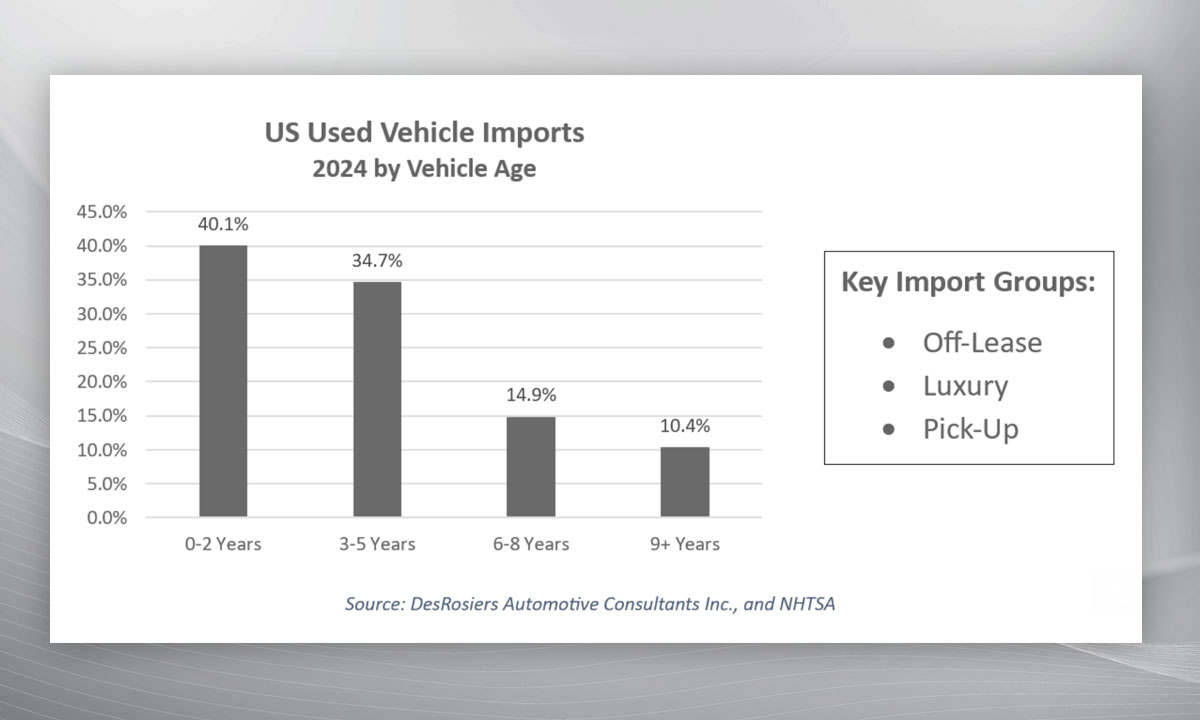

The data, published in the DesRosiers Used Vehicle Report, highlights how cross-border flows are reshaping used-vehicle supply in Canada and influencing pricing and sales dynamics. Younger vehicles dominated the export mix, with more than 40 per cent of imported units entering the U.S. being 0-2 years old. Another 34.7 per cent were 3-5 years old. The numbers fall sharply for older model years.

The composition skews toward off-lease units, luxury brands and pickups: segments already in tight supply in Canada. The overall trend is also not new. “In recent years, hundreds of thousands of young Canadian used vehicles have been flowing to the U.S. each year,” said Andrew King, managing partner at DAC, in a statement.

But new uncertainties are emerging. King noted that recent U.S. tariff policies have “thoroughly muddied the waters,” making it difficult to predict future export patterns or the impact on Canadian retailers.

Because most used vehicles entering the U.S. originate in Canada, shifts in volume or mix directly affect domestic supply. A stronger U.S. pull reduces availability for Canadian dealers, supporting higher wholesale prices and putting pressure on used-vehicle sales volumes. Conversely, any slowdown in exports could create sudden inventory relief.

DAC says brand-level import data is becoming essential for OEMs and dealer groups assessing how cross-border demand affects both new-vehicle allocation and used-vehicle operations in Canada. The firm continues to track these movements as part of its annual Used Vehicle Report.