The second annual CCAM Summit returned to Montreal this week with an all-star speaker lineup that included Hockey Hall of Famer and hometown favourite Guy Carbonneau, who helped lead the Montreal Canadiens to two Stanley Cups. Dealers heard Carbonneau talk about his leadership philosophy and how to build a winning team.

The Corporation des concessionnaires automobiles de Montréal (CCAM) organized the full-day event on the eve of the opening of the Montreal International Auto Show. Denis Dessureault, CCAM President and CEO, opened the Summit with a welcome address. “Last year we launched this Summit with a clear intention. Create a space for reflection, exchange and dialogue with dealers and our industry,” he said speaking in French. “Our industry is evolving rapidly.”

He said the association’s role was to stay active and provide support for members to help ask and answer the key questions they are facing.

Derek Sloan, President and CEO of Sym-Tech Dealer Services, the event’s exclusive sponsor, gave an opening message, calling the summit one of the most important events for the auto retail industry in Montreal. He said the industry was in a period of rapid transformation and change, and although there were challenges, there were also big opportunities for those willing to adapt.

Francis Vallée, Vice-President, Sales, Quebec at Sym-Tech Dealer Services, took the stage to provide a warm welcome to attendees. He said every year dealers face hurdles and rise to the challenge. Vallée said he had confidence the dealers would continue to offer high quality products that consumers will embrace.

The event’s emcee and moderator Isabelle Maréchal, a well known media celebrity in the province, gave an energetic message to get the event’s formal sessions started.

Charles Bernard, Chief Economist for the Canadian Automobile Dealers Association, opened the formal presentations with a briefing on Canada’s political and economic landscape. He said the Quebec vehicle market was down 2 per cent in 2025, largely driven by the decline in electric vehicle sales after the removal of incentives and the disruption from the arrival of tariffs imposed by the U.S. on vehicle imports from Canada.

Bernard took dealers through the political landscape, leading to the election of Prime Minister Mark Carney, including the impact of tariffs and the economic shocks related to policies from the United States. He outlined CADA’s five-part Automotive Competitiveness Framework that was unveiled during the federal election campaign. It outlined key planks the association was calling for to support the industry and dealers. Bernard showcased all the media coverage the association leaders were garnering to help defend dealer interests at the national and provincial levels.

He showed projections on Canada’s economic growth in 2025 and in the years ahead — and it was showing slow growth. Despite the shocks and uncertainty, he said consumer confidence remains fairly solid in Canada.

Bernard also touched on vehicle affordability and its impact on vehicle sales given the added pressure of the rising cost of living and flat salary growth for Canadian consumers. And he presented some evolving perspectives on the changing characters and personalities of vehicle buyers, noting differences between generations.

CCAM used the summit to unveil the inaugural Prix Reconnaissance CCAM, recognizing a Montreal-area dealer who made a significant contribution to the industry and to the association. The winner was Sylvie Dagenais, who was greeted with a standing ovation from her dealership peers. Dagenais was the first woman to serve as president of the CCAM and the Montreal International Auto Show and founded the CCAM Foundation.

In her brief speech, Dagenais said it was important for dealers to innovate and move forward, but it was also key for them to give back to their communities, not as an obligation, but as a privilege. She said dealers needed to share their success with others, and support the communities they operate within.

Ian P. Sam Yue Chi, president and chief executive officer of the Corporation des concessionnaires d’automobiles du Québec (CCAQ), updated dealers about legal issues impacting dealers and F&I and an update on Bill 30 that upends the rules and regulations concerning selling a wide variety of finance and insurance products in the province. He said on July 1, 2026, dealers will no longer be able to distribute and sell certain F&I products. He said the products offered by F&I providers will evolve, and dealers will have to adapt their methods.

He said the CCAQ has “enormous confidence” that the F&I industry will adapt to offer insurance products for Canadian consumers that will still include revenue opportunities for dealers who offer them to car buyers. Yue Chi said there will be challenges during the transition, and the industry will continue to evolve along with dealers, while satisfying the government’s need for transparency and protecting consumer interests.

He took dealers through a history of how dealers and governments had evolved the discussions and processes for selling F&I products in the province. He said there will be new products offered in the market in July 2026, but the problem was never the products. Yue Chi said 60 per cent of the province’s dealers had gone through the association’s own certification program regarding insurance products, and 328 Quebec dealers have completed phase 2 of the certification.

The Summit’s celebrity keynote followed, as moderator Isabelle Maréchal sat down for a fireside chat with hockey legend Guy Carbonneau.

Carbonneau was one of the NHL’s premier defensive centres and a leader on multiple Stanley Cup-winning teams. He played 19 seasons in the NHL winning three Stanley Cups along the way, two with Montrreal and one with the Dallas Stars. He was elected to the Hockey Hall of Fame in 2019 and was head coach of the Montreal Canadiens from 2006-2009.

Speaking in French, Carbonneau said he learned about leadership at a young age. He said when he played sports as a kid, he made sure none of the other kids were left on the sidelines. “I wanted everyone included,” said Carbonneau. This translated into how he played with his teammates.

He said when he started in the NHL there were a lot of Canadians, and Americans in the league but fewer Europeans. At that time he made sure to try to include the Europeans in team events and make them feel welcome, even if there were cultural and language barriers. “In business it’s the same,” said Carbonneau. He said no matter how good the player, whether Wayne Gretzky, Mario Lemieux or Connor McDavid — no one can win alone, it takes a team.

Carbonneau said he adored playing hockey, but he said even if he was one of the better players on the team, he knew he couldn’t win without the efforts and success of all the players. He said they played different positions, had different skills and made varying amounts of money, but they all needed to excel for team success.

Maréchal asked him about playing under pressure. He said when he started coaching the Montreal Canadiens in 2006, he recognized the pressure that came with the job, and managed the success of 23 players. He said all those players were used to being the stars and top players on their teams throughout their careers, but when they arrive in the NHL you have to treat them differently and give them specific roles for team success. “I found that very hard,” said Carbonneau.

He said he had to adapt to the new generation of players when he got behind the bench. He said you have to really know your players, and the coaches’ relationship with the players has changed. He said he never would have thought to demand more ice time or talk about his own role with the coaches.

Many of the lessons Carbonneau was describing applied equally well to business. Carbonneau said to help motivate team members who are underperforming, for example, you need to work with them on some short term achievable goals, and then some longer term goals you can work towards.

Dealers later posed for photos and chatted with Carbonneau at the Sym-Tech sponsor booth.

The afternoon program opened with a presentation from Niel Hiscox, publisher of Canadian auto dealer and co-founder of Clarify Group, an automotive consultancy and research firm. Hiscox was part of a CADA-led tour to Shanghai in 2025 to learn more about the Chinese auto industry, their products and their plans for the future. He said he had been paying close attention to the Chinese auto market in recent years, and the China study tour gave him a chance to continue his ongoing explorations.

He summarized the current situation facing North America and Canada in particular as: “A flood of cars banging up against a wall of tariffs.” The Chinese OEMs currently make enough cars to meet 75 per cent of the world’s demand. Since they can’t sell all these cars in China they need to find homes for the cars they produce.

But he said slowing down auto manufacturing in China isn’t easy, because the states and regions all compete for dominance and government supports and don’t want to slow down. Hiscox said the fact Canada and the U.S. don’t have Chinese-made EVs has them out of step with the rest of the world where you can easily find Chinese made vehicles. “That won’t be sustainable,” said Hiscox.

Hiscox said that it’s also important to understand that the Chinese are also pivoting away from only building EVs and are also producing hybrid, plug-in hybrids and extended range vehicles. So their current technology and sales advantages will continue in all product categories. The Seal by BYD, for example, is currently the best selling EV model in Europe, displacing the VW Tiguan.

Hiscox said as the situation evolves in the months and years ahead, dealers and analysts will have to determine who the winners and survivors will be in the Chinese OEM landscape. In 2023, he said there were 137 Chinese OEMs and it’s predicted by 2030 there will only be 19 who survive. So for dealers, who do they invest their time and energy in? Hiscox offered some stats about some of the current leaders like BYD, Chery, Geely and Xiaomi.

He said the Australian experience with Chinese OEMs is also worth studying. They used to have domestic auto manufacturing, but since it’s been shut down they opened their markets. The Chinese currently have about a 20 per cent market share in Australia. What that means is some dealers are having great success with the Chinese OEMs, but they are also losing ground with their other brands.

Hiscox said last year’s CADA study tour had about 15 people, but this year the CADA will bring more than 60 dealers on the 2026 tour in the spring.

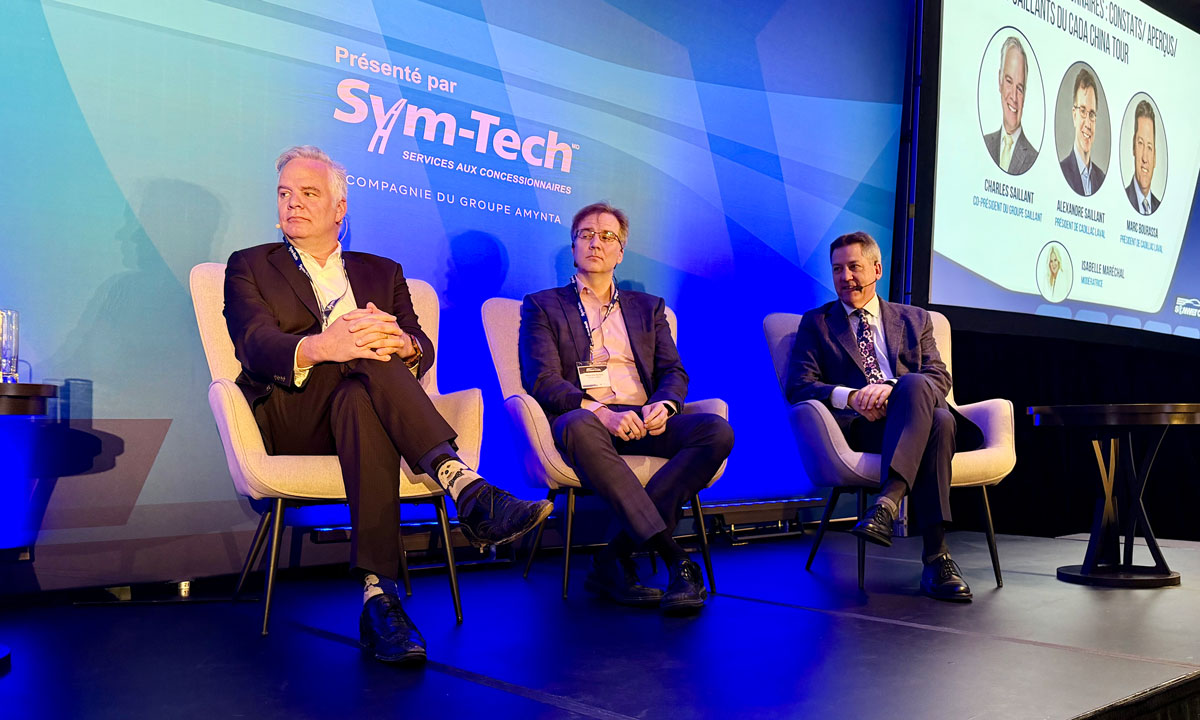

Next up was a dealer panel moderated by Maréchal made up of Montreal-area dealers, who also participated in the CADA China study tour: Charles Saillant and Alexandre Saillant Co-Presidents, Groupe Saillant, and Marc Bourassa, Dealer Principal Cadillac of Laval.

Charles Saillant and Alexandre Saillant Co-Presidents, Groupe Saillant, and Marc Bourassa, Dealer Principal Cadillac of Laval

Charles Saillant said he was really amazed at the technology and digitization of the in-vehicle experience in the Chinese made models. Alexandre Saillant said he too was struck by the quality of the vehicles. He expected a high volume, low quality mix of products but that’s not what he found.

For his part, Bourassa said he always imagined the Chinese would be good at copying other products or models, but that’s not what he encountered. The connectivity was incredible between the phone, the home and the car. He also found the vehicles he looked at were super high quality.

The dealers shared their impressions of the market and products.

Maréchal asked the dealers what they thought would unfold in Canada, and was it a matter of when, not if they would arrive to sell vehicles in Canada. Bourassa said Europe had put a good model in place where they used the tariff levels to make the prices of Chinese models fair vs. the other models in the market.

Charles Saillant said he expects Chinese OEMs will arrive but it’s yet to be determined how the market will look within Canada. Saillant said they talked to some dealers who were happy with their Chinese OEM franchises and others were less happy. The intense competition between OEMs also makes it difficult to determine which ones would make good partners.

Bourassa said CADA and dealer associations need to be mindful that the Chinese OEMs do arrive and set up shop in Canada using a dealer network initially, that they don’t later shift to an agency model once they’ve gained market traction.

Charles Saillant urged dealers to sign up for the next CADA China tour and singled out Bruce Rosen, CADA’s Executive Director External Relations who organized the study tour. “With Bruce Rosen we have an excellent guide. It’s an investment in your future,” said Saillant.

Bourassa echoed the sentiment and urged interested Quebec dealers to sign up for the CADA study tour and go see it all for themselves.

After the panel, dealer attendees bombarded the dealer panelists with all sorts of questions about what they witnessed in China, which OEMs were most at risk, what Chinese dealerships were like versus ones in Canada.

Aurélien Debec, founder and president of aConnect, followed with a presentation on the growing role of artificial intelligence in dealerships. Debec said research found that 72 per cent of AI users say it improves human performance. Debec said AI was like a new energy source powering human capabilities. He said the number one use of AI tools in dealerships so far is in marketing and advertising, with 34 per cent of dealers saying they use it for those services.

Debec said AI voice agents are now being used to provide information to customers 24/7, it understands multiple languages and knows the dealership hours and services and many more specific details about the dealership’s operations. He said the next generation of AI voice assistants use much more natural language and are more effective connecting to back-end systems.

Debec presented a case study where the AI system was used in a BMW dealership in Europe for 1 month. After 3,500+ calls, they had 99 per cent of correct understanding of the caller’s intention, and responded in .08 seconds. He said the trial led to a 9 per cent increase in sales, 18 per cent increase in service bookings and $74,000 in additional revenue.

He said AI voice agents can automate 60-80 per cent of simple calls dealerships field for sales questions, hours and schedules. Debec played some examples of actual calls where the AI voice assistant interacted with a dealership customer and onboarded their information and request.

Yamina Tsalamlal, director of specialized research at Léger (Montreal), closed the day with a presentation on key trends shaping the experiences of newly arrived immigrants to Canada, including their motivations for settling in the country, financial circumstances, purchasing habits, and patterns of online behaviour and engagement.

She took dealers through recent studies from 2024 and 2025 that featured interviews with thousands of newly-arrived Canadians to Quebec. She categorized newly-arrived Canadians as those within Canada for less than 10 years. She said research found 70 per cent arrived to Canada for economic reasons, and 83 per cent of those have university degrees or advanced degrees: they are in search of the “Canadian dream.” “They are ambitious and educated,” said Tsalamlal.

For the study, 43 per cent of the newly-arrived Canadians spoke French. In terms of language spoken at home, 55 per cent spoke French, 18 per cent spoke English, 9 per cent were Arabic-speaking and 7 per cent spoke Spanish. Tsalamlal said these citizens have encountered different types of pressures living in Canada, including racism and the fears of discrimination, which adds to the economic pressures felt by most Canadians.

She said for these newly-arrived Canadians, the purchase of a vehicle is an important milestone on their path to financial independence, which takes on average 14.5 months. In the study, 24 per cent had not yet bought a vehicle, 10 per cent bought one within their first month of arrival, and 42 per cent had purchased a vehicle within their first two years of arrival.

The studies found 83 per cent find Canada more expensive than they expected, and less than half (48 per cent) say their finances are in good shape. She advised dealers to better understand this population, their needs and circumstances so they can build better and long-term relations with them for their automotive needs.

Sym-Tech Dealer Services is the event’s exclusive sponsor.