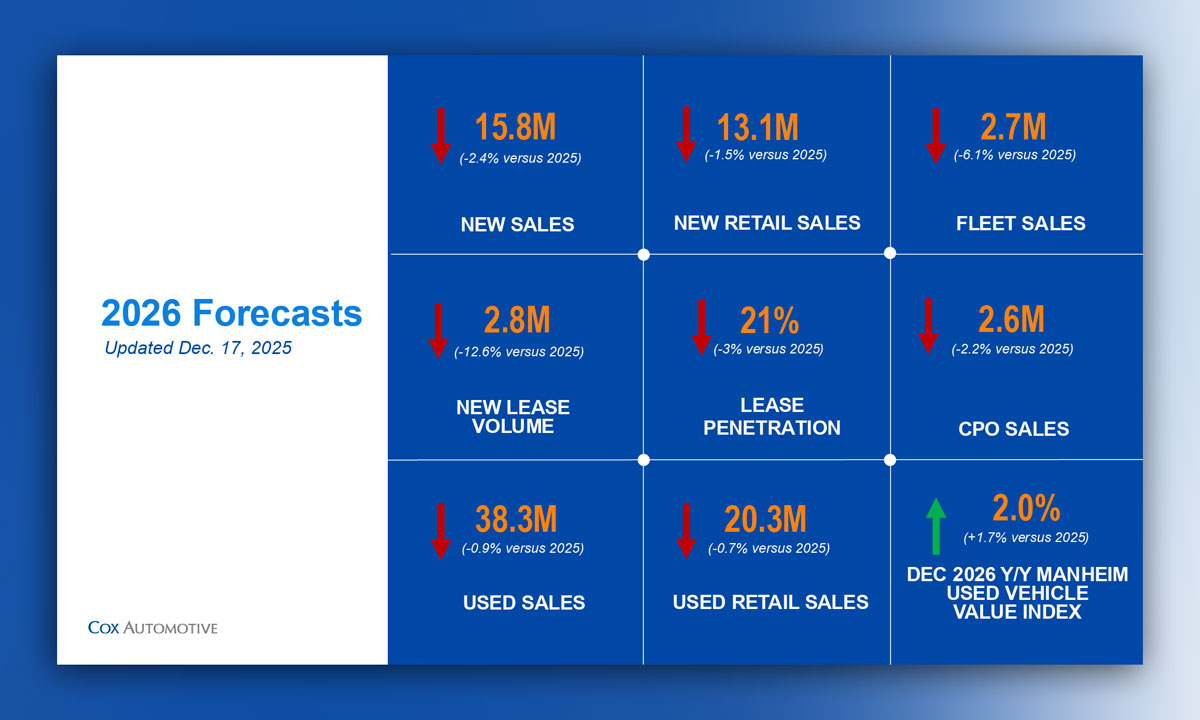

Cox Automotive is projecting U.S. new-vehicle sales will ease in 2026 after a stronger-than-expected 2025, as affordability pressures and policy uncertainty keep the market uneven. In its 2026 automotive industry outlook released this week, Cox forecasts 15.8 million new-vehicle sales in 2026, down 2.4 per cent from 2025.

“The fact is, most vehicle sales metrics in 2025 were slightly stronger than many forecasts – including us,” said Jeremy Robb, interim chief economist at Cox Automotive, in a statement. “Our 2026 forecast reflects a slowing market, but still a good one.”

While Robb said the company is expecting most sales metrics to be lower compared to the previous year, he also noted the expected declines are modest, “and we think there will be good news on interest rates and tax returns that help the auto market in the first half of 2026.”

Cox said the outlook reflects diverging consumer conditions, with higher-income households expected to benefit from wealth effects, tax relief and rate cuts, while lower-income buyers continue to feel inflation and elevated vehicle prices. The company also said that the split is expected to accelerate trade-down behaviour.

They cited slow job growth, lingering inflation risk and uncertainty around industrial policy, including tariffs and fuel-economy adjustments. Cox said the U.S. electric-vehicle market is expected to enter “its next chapter” in 2026 as incentives fade and off-lease EVs add used supply.

Among the key forecasts, Cox expects retail new-vehicle sales to fall 1.5 per cent year over year, while fleet sales are projected to decline 6.1 per cent. Overall leasing is forecast at 21 per cent, down three percentage points from 2025, with EV and plug-in hybrid lease penetration expected to drop. Cox also expects a slight dip in retail used-vehicle sales and forecasts the Manheim Used Vehicle Value Index will rise two per cent by the end of 2026.