A year of living with new vehicles, and not just analyzing data, is increasingly critical to understanding how models will hold value in Canada, according to Canadian Black Book.

In its 2025 Vehicle Testing Round-up, CBB said its team drove more than 100 new vehicles over the past 12 months to assess year-over-year changes in content, competitiveness, capability and livability. The goal is to understand how a vehicle “ages” within its segment and how that evolution impacts future valuations and residual values.

“As we are regularly asked, ‘Why does CBB need to test vehicles?’ the answer is simple: to gain an improved understanding of how a new model ages over time given its evolving competitive landscape and how this impacts future valuations,” the report said.

CBB’s testing leaders highlighted a mix of practical wins and costly misses. Stephen Smith, manager of residual values, named the Honda Civic Hatchback Touring Hybrid his top pick, calling it: “Best all-around vehicle, providing a livable, affordable, stylish, and fun-to-drive experience that does just about everything very well.” His lowlight was the Acura ADX Platinum Elite A-Spec, which he described as: “a very forgettable vehicle in its segment.”

David Robins, head of Canadian vehicle valuations, picked the Hyundai Ioniq 9 Ultimate Calligraphy as his highlight, calling it the best seven-passenger EV for range, equipment and space. His lowlight was the Mitsubishi RVR GT, flagged for its aging platform and lack of refinement.

Daniel Ross, senior manager of industry insights and residual value strategy, highlighted the Toyota Land Cruiser 1958 Edition for delivering “basic requirements and nothing more” with strong character, while naming the Ford Bronco Raptor his lowlight due to price increases without meaningful real-world benefit.

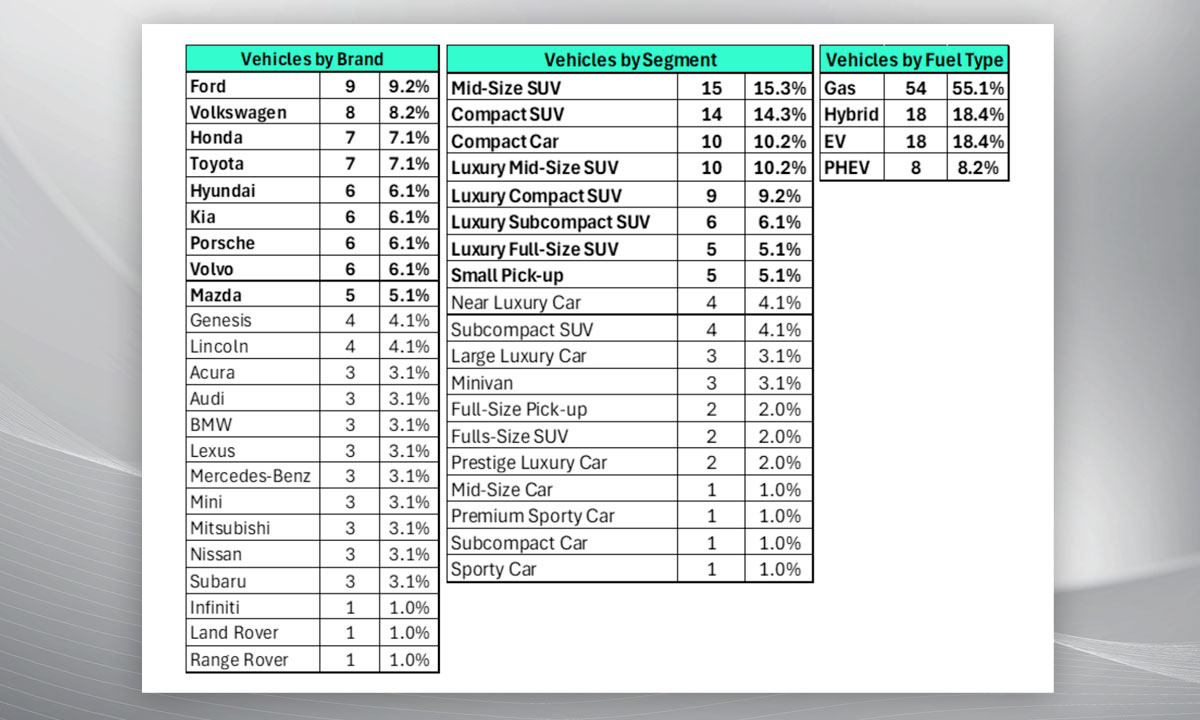

On the broader market, CBB said mid-size SUVs dominated testing in 2025, representing 15.3% of models tested — plus another 10.2% from luxury mid-size SUVs. Electrified vehicles were also prominent: EVs and hybrids each represented 18.4% of testing, while CBB pointed to plug-in hybrids as an under-served category with growing opportunity.

CBB also highlighted a growing pricing gap. While mainstream brands accounted for 44% of vehicles tested, the average as-tested MSRP came in at $84,049, compared with an average retail listed price of about $60,000. The lowest-priced vehicle tested was the Kia K4 EX at $28,695, while the highest was the Mercedes-Benz G580e at about $235,000, delivering less than 300 km of winter-tested EV range.

CBB said this supports an emerging trend: mainstream models are bringing more technology and value to buyers, while luxury vehicles may struggle to differentiate. This may potentially weaken long-term value retention for high-priced niche models.