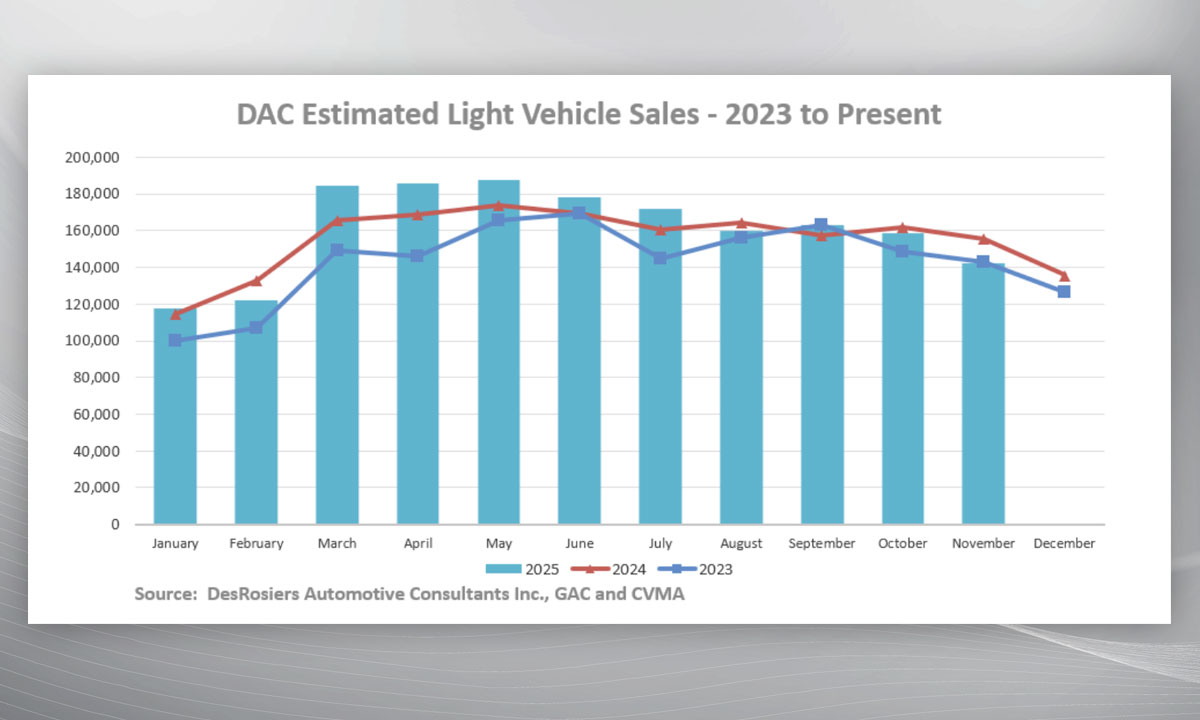

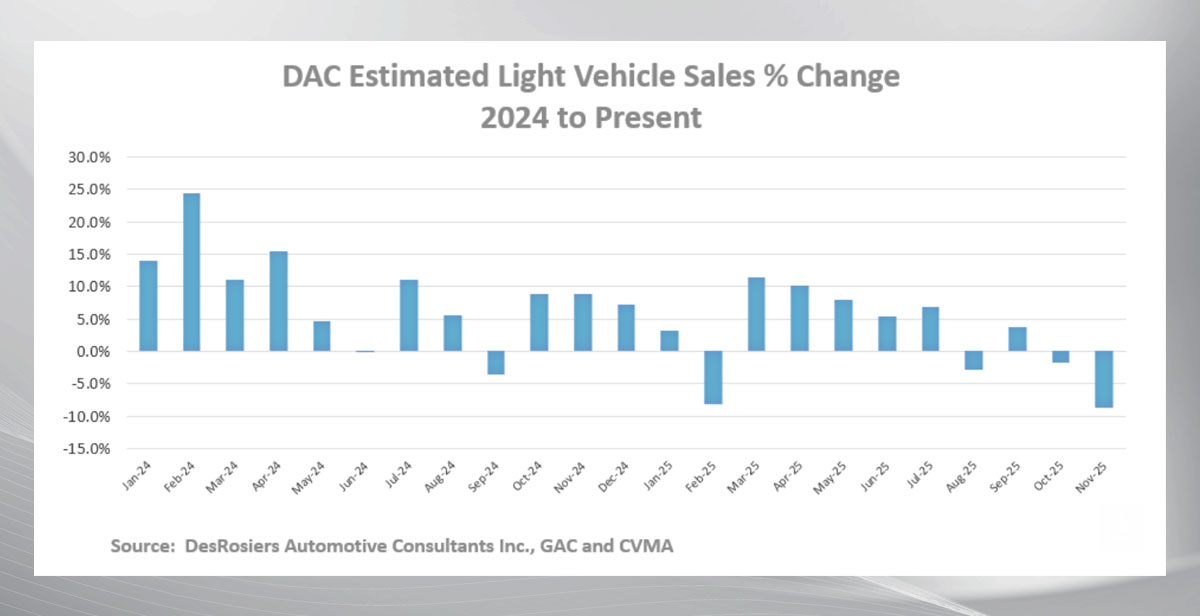

Canada’s automotive market posted an 8.6 per cent decline in November, with estimated sales of 142,000 units, according to DesRosiers Automotive Consultants (DAC).

Most high-volume OEMs recorded lower results, reflecting the broader economic pressures that have shaped consumer behaviour throughout the year so far. Andrew King, managing partner of DAC, cautioned against viewing the month’s performance in isolation.“When you delve a little deeper, the picture is maybe not as bad as it first appears,” he said in a statement.

Dealers should note that November 2024 was an unusually strong benchmark. It was driven largely by Quebec consumers rushing to buy zero-emission vehicles ahead of policy changes that meant no more rebates. That month became the first November since 2017 to surpass 150,000 units. It’s also a month that recorded a 2.04-million SAAR. This year’s results were also affected by one fewer selling day.

Despite the collapse of ZEV demand and ongoing economic challenges, November 2025 delivered a 1.87-million SAAR. It’s a weaker outcome, but still within historical norms. DAC noted the pace ranked seventh among the 11 months to date. It was comparable to pre-pandemic levels, including the 144,000 and 145,000 units recorded in November 2018 and 2019.

DAC said the data suggest resilience rather than a sharp downturn, even as affordability pressures and shifting consumer sentiment continue to influence the market.

For dealers, November’s results underline a continued caution among buyers but not a collapse in demand. And comparables become more favourable in early 2026, suggesting the possibility of steadier year-over-year results. Dealers may also see more predictable showroom traffic as ZEV-related volatility eases and inventory levels normalize across segments.