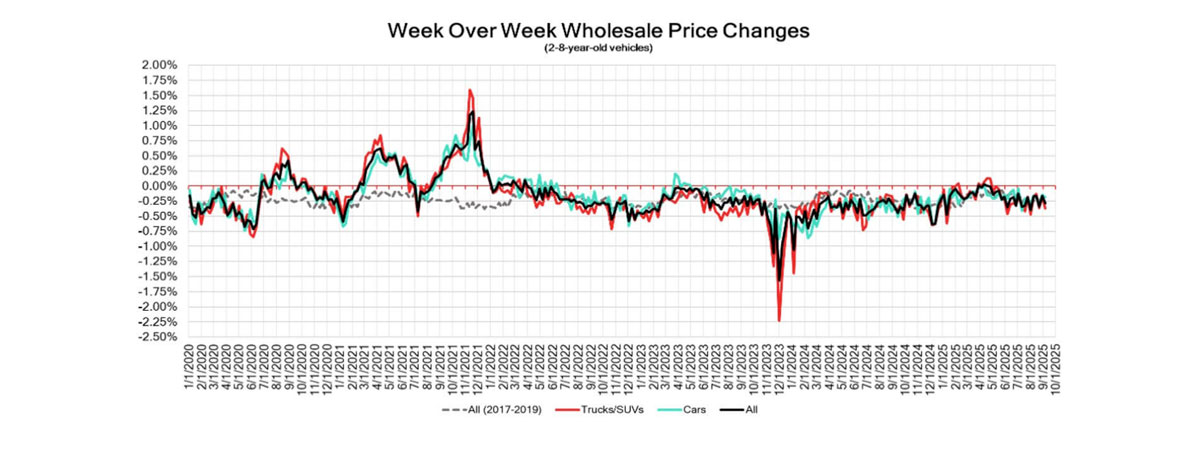

The Canadian used wholesale market saw prices decline -0.29% for the week ending on September 6. In comparison, the prior week’s report had prices down by -0.16%, according to Canadian Black Book.

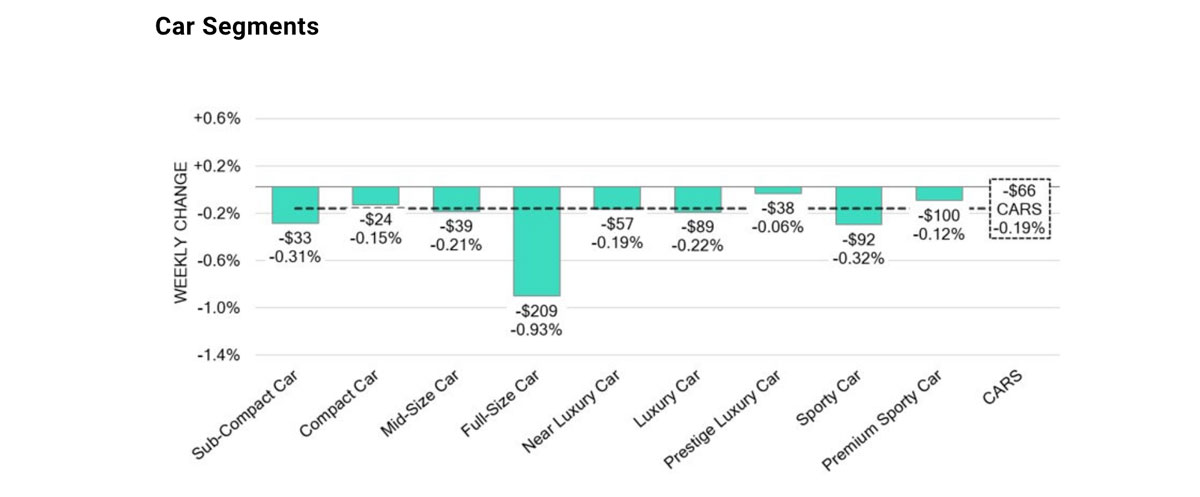

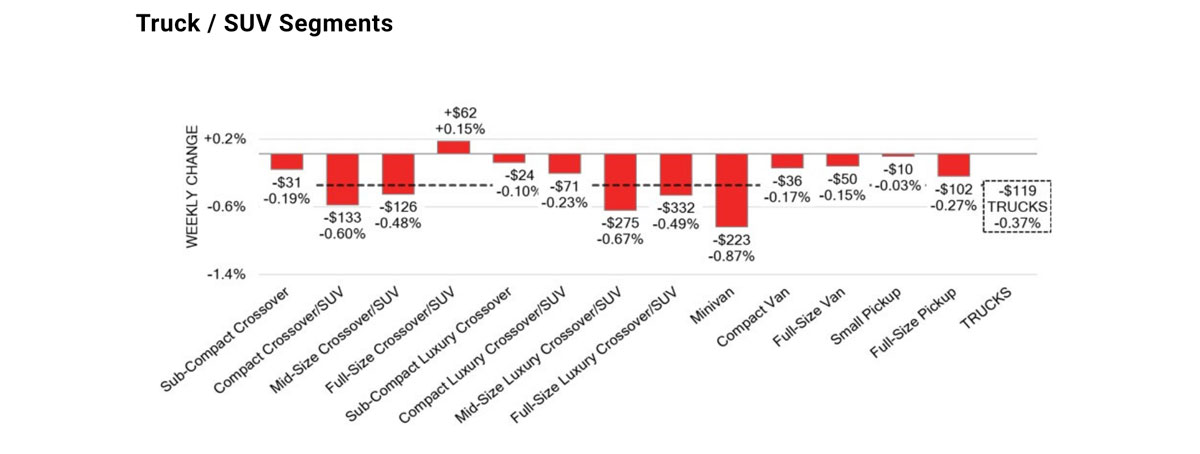

Its Market Insights report shows car segment prices decreased -0.19%, whereas the decline was -0.14% a week earlier. And truck/SUV segments were down by -0.37%, compared to last week’s reported -0.18%. This week’s positive segment was full-size crossovers/SUVs at +0.15%.

“The Canadian market remains on a downward trajectory, showing a steeper decline compared to in its prior week. Car segments experienced a 0.05% adjustment … (and) truck segment values recorded a 0.19% change…,” said CBB in its update. “Slightly more than 36% of market segments recorded an average value change exceeding ±$100.”

In the car segments, the most significant declines came from full-size cars (-0.93%), sports cars (-0.32%), and sub-compact cars (-0.31%). The smallest declines were seen from prestige luxury cars (-0.06%), premium sports cars (-0.12%), and compact cars (-0.15%).

For trucks/SUVs, the segments with the largest declines were minivans (-0.87%), mid-size luxury crossovers (-0.67%), compact crossovers/SUVs (-0.60%), and full-size luxury crossovers/SUVs (-0.49%).

The average listing price for used vehicles slipped, as the 14-day moving average was at $37,700.

On monitored auction sale rates, CBB said these ranged from 16.9% to 50.9% during the current reporting period, averaging 31.2%.

“Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices,” said CBB. “Supply levels remain stable; however, upstream channels are still gaining priority sale access to inventory.”

In the United States, CBB said lane activity slowed as conversion rates dipped Post-Labor Day, and depreciation resumed in line with late-summer norms.

“While last year was unusual — showing positive trends both before and after the holiday — this year’s pre-Labor Day period was merely stable, with a few segments gaining. That strength faded last week as depreciation followed the more typical early-September pattern.”