A new study from J.D. Power reveals the importance of relationships, in that automotive lenders seeking to capture a bigger piece of the market must focus on building and cultivating relationships with dealers.

The company’s 2024 Canada Dealer Financing Satisfaction Study, released just this week, measures new-vehicle dealers’ satisfaction with their finance providers. The report found that auto retailers who have relationship-based interactions with their lender are much more satisfied — by 54 points — than those who have only transactional interactions. The scores are based on a 1,000-point scale.

“The numbers overwhelmingly show that lenders who build and maintain holistic interactions with dealers are more likely to generate additional business than on deals that only hinge on compensation,” said Patrick Roosenberg, Senior Director of Automotive Finance Intelligence at J.D. Power, in a statement. “(Lender’s) sales reps play a critical role in nurturing and managing those relationship-based engagements.”

Roosenberg also added that lenders should invest in and empower their sales reps by providing them with the tools to be highly effective in cultivating those relationships. “One example is to keep an effective rep-to-dealers ratio,” he said. J.D. Power’s study found that relationship-based dealers, who are more satisfied, are 36 per cent more likely to send additional business to the lender within the next 12 months.

Study rankings show that Ford Credit and Kia Finance tied in the captive prime segment, each with the highest score of 812. Hyundai Motor Finance follows with 784 points and ranks third.

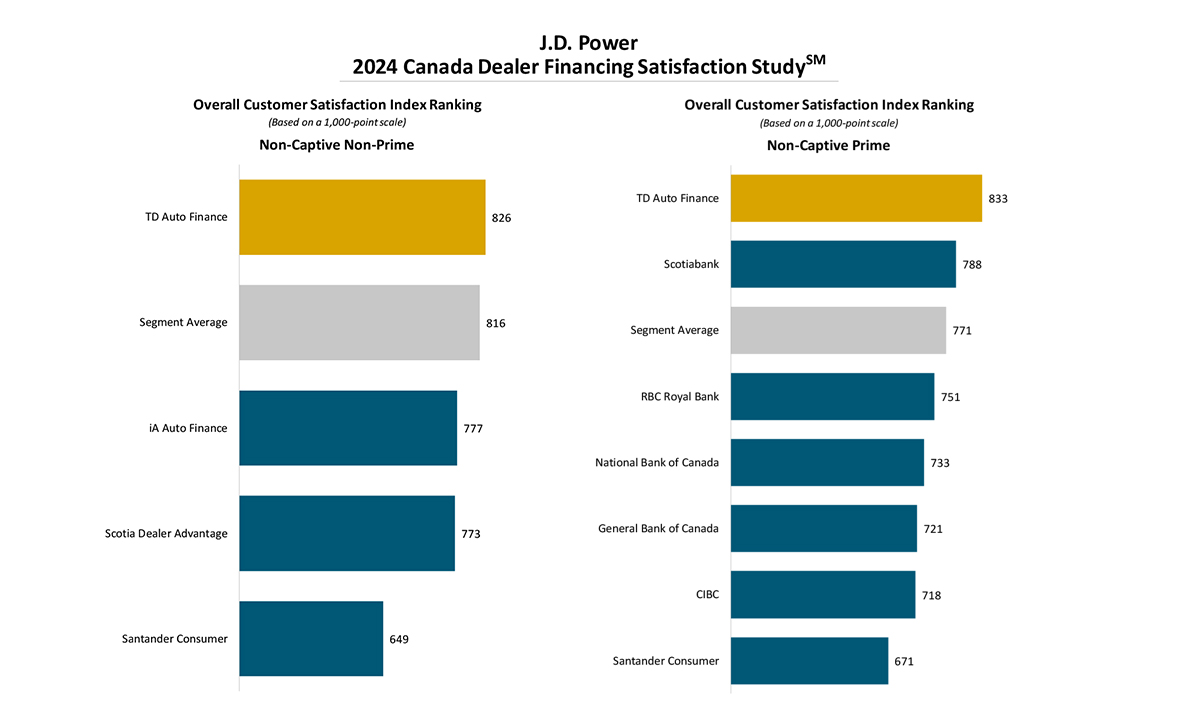

In the non-captive prime segment TD Auto Finance ranks highest with a score of 833, while Scotiabank ranks second with 788 points. In the non-captive non-prime segment, TD Auto Finance ranks highest for a seventh consecutive year thanks to a score of 826 points.