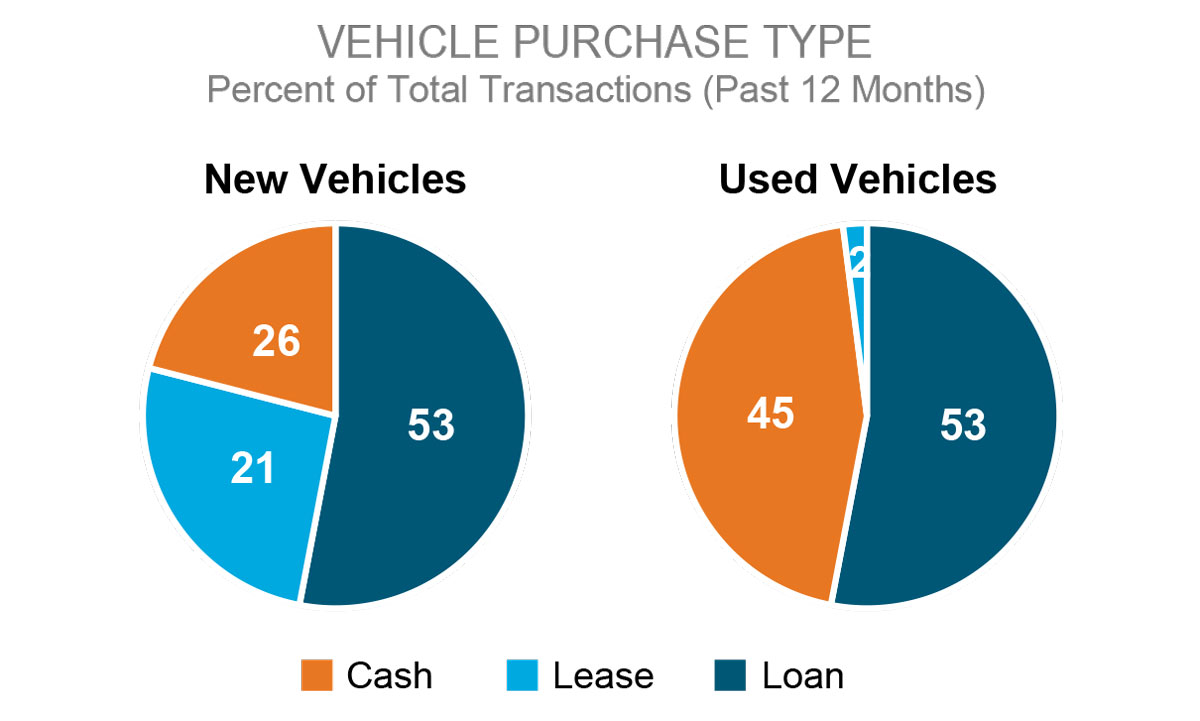

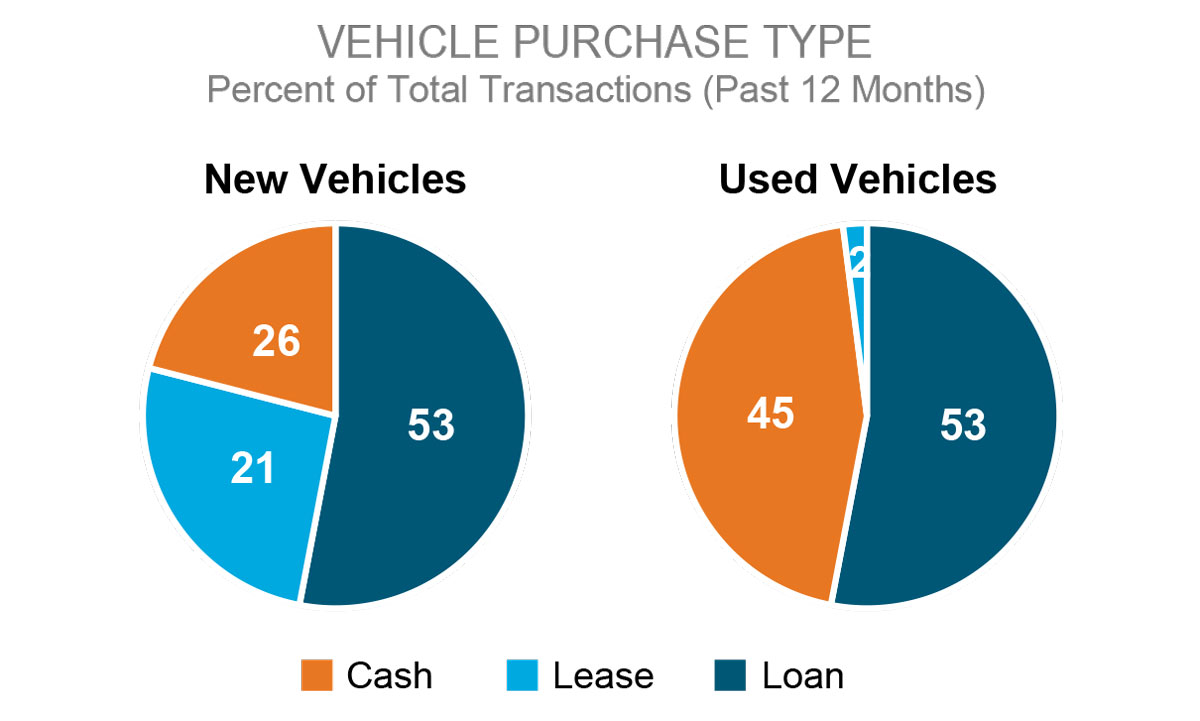

Loans represented 53% of total transactions for new vehicles over the past 12 months, while cash was 26% and 21% were leases, according to J.D. Power’s Canada Automotive Market Metrics for February 2024.

The report, recently released, shows that loans also represented 53% of total transactions for used vehicles over the past 12 months, while cash was 45% and leases were a mere 2%.

Dealers may also be interested to note that, when considering the average monthly payment per customer, new leases represented between $720-$760 in February (down every month prior from a year ago). New loans represented closer to $860-$880, which is down from the previous month and a year ago.

As for the percent of new vehicle loan terms, for 84 months and more, February 2024 represents 58% — greater than January 2024 and February 2023. For days to turn, new vehicles were around 50 days, and used vehicles slotted somewhere between 80-85 days.

J.D. Power also pulled data from the JDPA PIN Incentive Spending Report (ISR) to compare new vehicle prices to customer-facing prices. The data shows that the average new vehicle price was around $49,000, down from all previous months and a year ago. And the transaction price was between $45,000-$46,000, also less than all prior months with the exception of February 2023, when the transaction price was even lower.

Data for the percentage of negative equity for vehicles at trade-in (new) show that negative equity is at about 20% (more than January 2024, less than February 2023, while trade-in hovers around 41-43%.