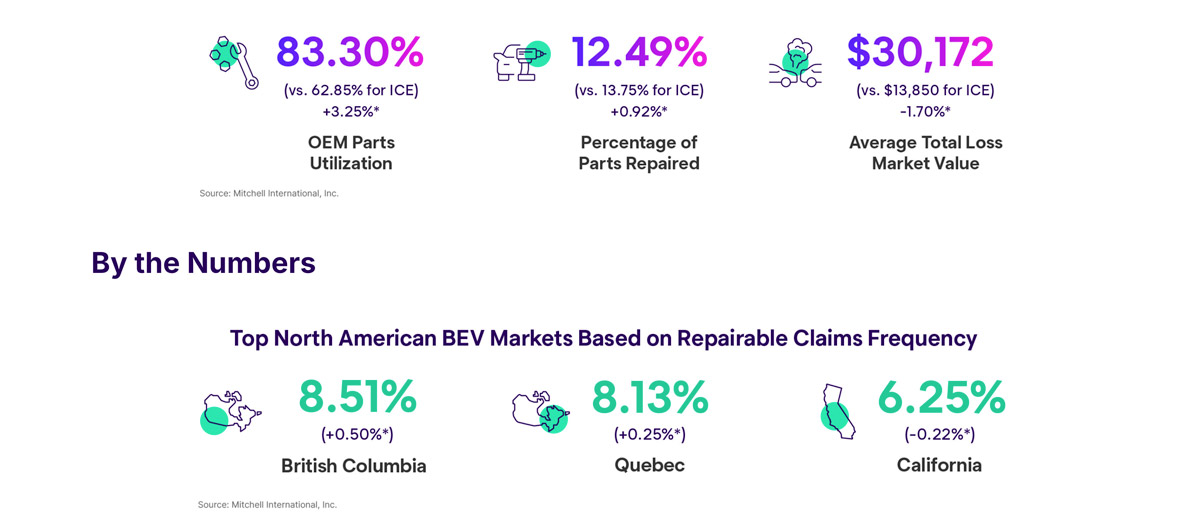

Dealers following the latest updates of the North American electric vehicle market may be interested to note that collision claims for battery electric vehicles have decreased in the United States. At the same time hybrid claims are surging, according to Mitchell International, a developer of auto physical damage technology solutions for claims management and collision repair processes.

The company released a second quarter 2025 Plugged-In: EV Collision Insights report that examined the decrease in collision claims frequency for repairable BEVs in the U.S. and increase in mild hybrid electric vehicle (MHEV) claims across North America. It also looked at the impact of government incentive programs on consumer adoption of BEVs in both the U.S. and Canada — something that directly affects dealers in Canada at the moment.

“We’re experiencing a significant shift in the electric vehicle landscape as the number of BEV claims in the U.S. dropped for the first time last quarter by 7%,” said Ryan Mandell, VP of Strategy and Market Intelligence at Mitchell, in a statement. “This decline coincides with a 6% year-over-year reduction in new BEV purchases despite strong sales in early 2025.”

Mandell added that claims for MHEVs reached around 5% in the U.S. and 4% in Canada. That translates to an increase of 2% and 9%, respectively, over the previous quarter, and 21% and 29% over the previous year.

In Canada, the frequency of repairable BEV claims continues to climb. It reached 4.83% in Q2 2025 representing a quarterly increase of 8%. But like the U.S., Mitchell said changes to government-sponsored incentive programs “are threatening vehicle sales.”

“According to J.D. Power, 42% of potential BEV buyers said they would be less likely to shop for an electric automobile without the incentives,” said Mitchell in its update. “In Quebec, where provincial BEV rebates were temporarily suspended, consumer interest declined 8%. This may contribute to slightly softer national sales in Q2 versus recent quarters.”

They added that traditional OEMs, such as Hyundai, Kia, Toyota, Ford and Chevrolet, are positioned to capture most of the remaining BEV market share in Canada, since Tesla plummeted 16% to eighth place among likely buyers.

The full report is available here.