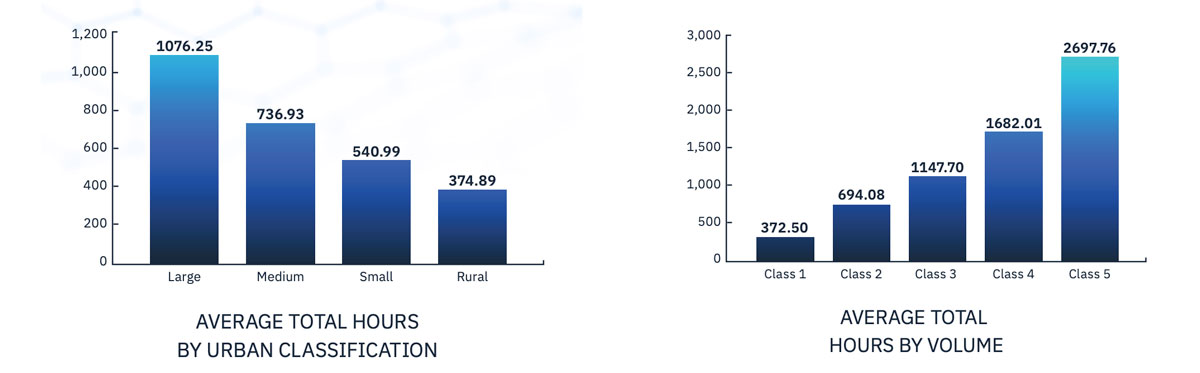

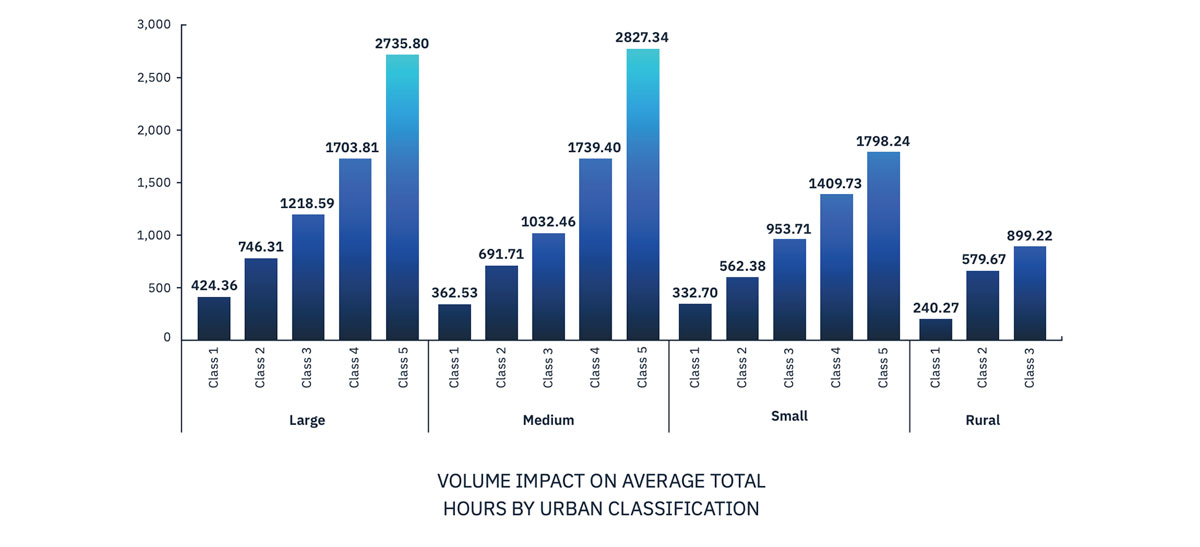

The outcomes on average for a service lane that handles less than 300 repair orders a month versus a service lane that handles 1,200 or more are very different, according to the data from Reynolds’ latest report reviewing Fixed Operations metrics for Canada and the United States.

The data also showed a dealership in a rural area will have different outcomes than a dealership in the dense urban core of a major city. For example, its report notes that “larger urban classifications, with more people and the availability of more potential hours, sold more hours than smaller classifications. Similarly higher volume stores naturally sell more hours than lower volume stores.”

Reynolds’ report covers 12 months of data from thousands of automotive dealerships across both Canada and the United States. The data was reviewed through two frameworks: urban classification and volume classification. The metrics tracked in the report are Total Hours sold on customer repair orders, Hours per RO, Effective Labor Rate (ELR), and Profit per Customer Pay RO.

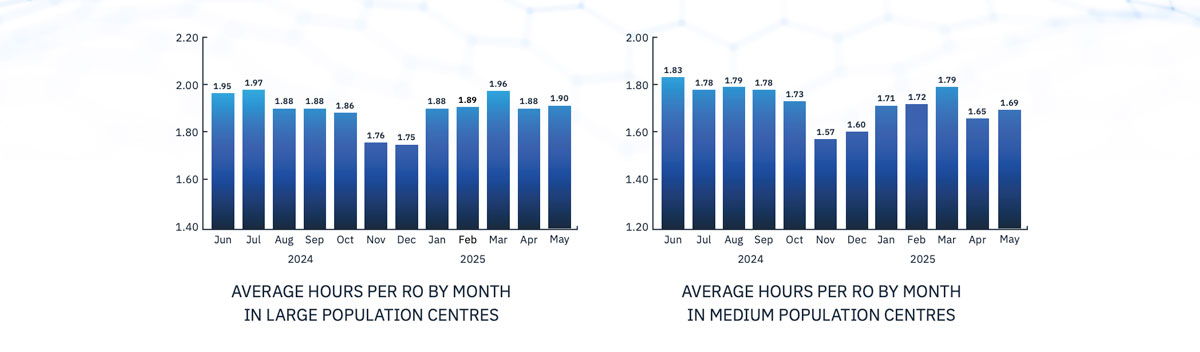

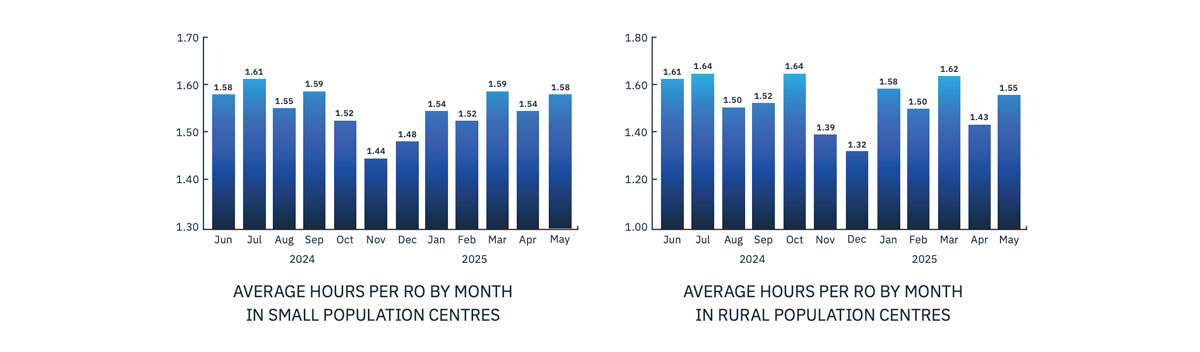

When comparing July and November data for dealerships in large population centres, Reynolds’ report shows that, on average, service departments experienced around 45 per cent more customers in November (834) than in July (574). And service departments, on average, sold approximately 37 per cent more total hours in November (1435.25) than in July (1049.7).

Some of the key findings in the Canadian report highlight a massive uptick in Total Hours sold in October and November, possibly linked to the increase in demand for seasonal tire replacement. Data also showed a notable decline in Hours per RO in November, likely linked to a boost in demand for seasonal tire replacement.

Other findings in the Canadian report show an upward trajectory in ELR as the year progressed — particularly in 2025. And a sizable decline in Profit per Customer Pay RO in November was observed, which Reynolds said was, again, likely linked to seasonal tire replacement.

One finding that was common to both the Canadian and U.S. report was that stores with a tool that creates efficiencies for the technician almost uniformly perform much better, across all metrics, compared to stores that do not have such a tool.