Canadian Black Book (CBB) released data for the week of July 28th showing small week by week gains that may indicate a slow strengthening across the industry. The report noted that the small weekly gains they’ve been tracking will make for a massive value adjustment when extrapolated over 52 weeks. However, CBB said that “only a portion of OEMs are voluntarily reporting monthly sales this year, and it makes it much more challenging to have a clear picture of the successes and struggles of the various brands.”

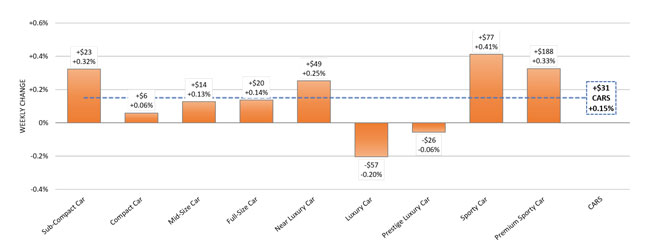

Highlights include small gains in July for the wholesale market, which has shown a continued strengthening of wholesale values for cars as well as trucks/SUV/crossovers with small increases of 0.15% and 0.19% respectively.

The sporty car segment, which is in the middle of its prime selling season had the biggest wholesale gain with an increase of 0.41%. Trucks continue to dominate the market, with the sub-compact crossover segment recording the biggest gains (1.16%).

The prestige luxury car segment and luxury car segment continued to decline, by 0.20% and 0.06% respectively, the only two of the nine segments to see a decline. Of the wholesale data, Canadian Black Book notes that “this is a mild increase, yet after an extended period of declines, it is the upward trend that is important.”

Source: COVID-19 Market Update. Canadian Black Book. July 28, 2020. Page 6.

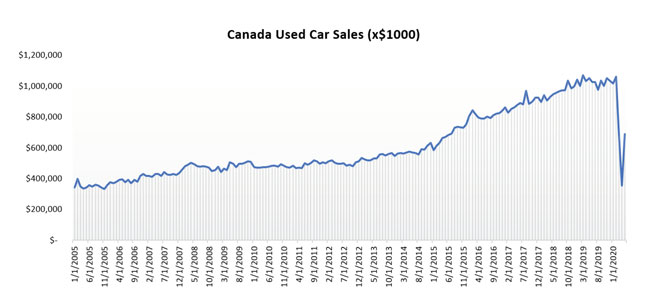

More surprisingly, dealers reported that used inventory levels on lots were much lower than normal. “The renaissance of sales in June, which has carried into July, has depleted stocks below the comfort levels of many used car retailers,” Canadian Black Book observes. “As a result, bidding at auctions remains intense with sales rates often cresting the 95% mark.” The industry anticipates that these values will soften once supply levels begin to rise.

Meanwhile, Statistics Canada’s retail sales data for May 2020 included used car dealer’s sales results, which were down 35% from the same month last year, a slightly smaller decrease than seen in April, which may support CBB’s observation that damage to the industry is slowing.

Source: COVID-19 Market Update. Canadian Black Book. July 28, 2020. Page 2.