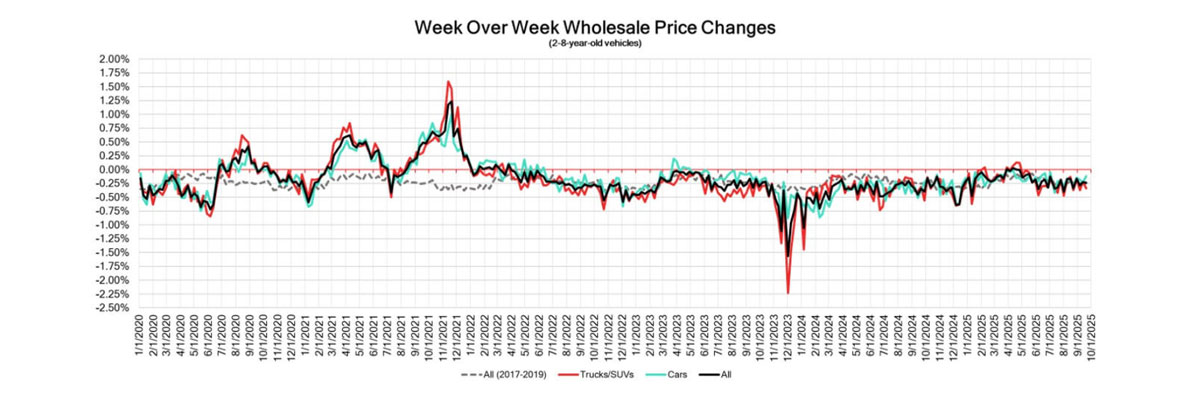

Canadian Black Book’s latest Market Insights report shows wholesale used vehicle prices continue to soften, with trucks/SUVs leading the decline.

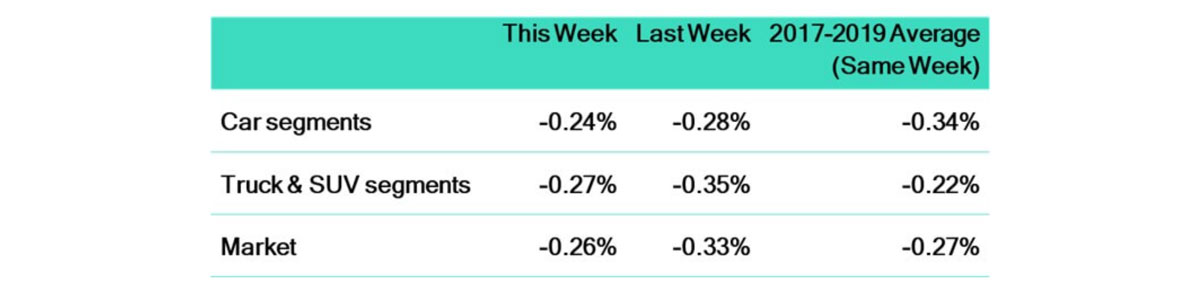

For the week ending Sept. 21, 2025, overall wholesale prices slipped -0.24%, compared to the prior week’s -0.23%. Trucks/SUVs decreased an overall -0.33%, versus last week’s -0.22% and with notably higher declines in certain segments. And the car category was down -0.12%, compared to the prior week’s -0.23%.

“The Canadian market continues to trend downwards heading into this week,” said CBB in its update. “Just over 36% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 19% to 87.1%, averaging 50.4%.”

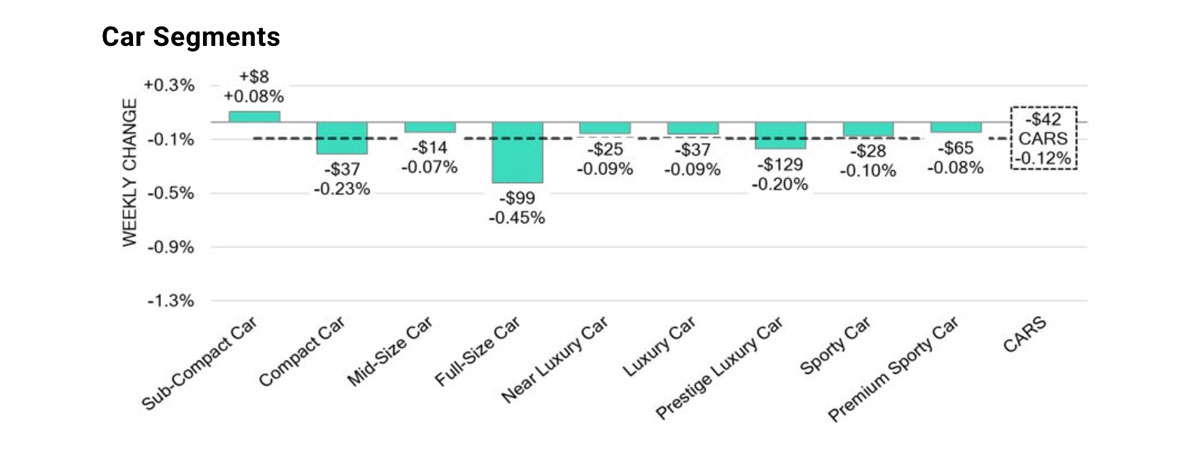

Among car segments, the largest drop in values came from full-size cars (-0.45%), compact cars (-0.23%), and prestige luxury cars (-0.20%). The smallest depreciations were experienced by the mid-size car (-0.07%) segment, followed by premium sports cars (-0.08%), near-luxury cars, and luxury cars (-0.09%).

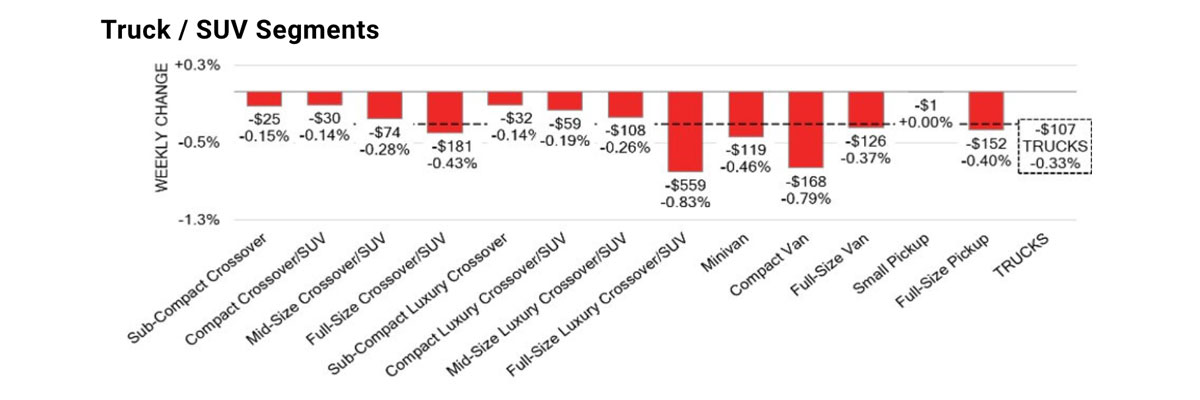

In the truck/SUV category, the largest decrease came from full-size luxury crossovers/SUVs with a notable -0.83%, followed by compact vans at -0.79%, minivans at -0.46%, and full-size pickups at -0.40%. On the least impactful side were small pickups (-0.01%), compact crossovers/SUVs and sub-compact luxury crossovers (each -0.14%).

The average listing price for used vehicles is slipping, as the 14-day moving average reached $37,600.

“Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices,” said CBB. “Supply levels remain stable; however, upstream channels are still gaining priority sale access to inventory.”

In the U.S., wholesale values were also down last week: cars slipped to -0.17% and trucks/SUVs declined -0.29%. CBB said nearly all segments moved lower, though premium sports cars edged slightly positive. “Auction conversion rates slipped to 59%, reflecting more selective buyer activity as depreciation resumed across the market.”

In other news, sales in Canada hit 8.6% for zero-emission vehicles in the second quarter of the year, with a slight decline against the first quarter. CBB said there has been a shift away from battery-electric vehicles, now down to 5.4% from 6.2%. But plug-in hybrids are up to 3.2% from 2.5%.