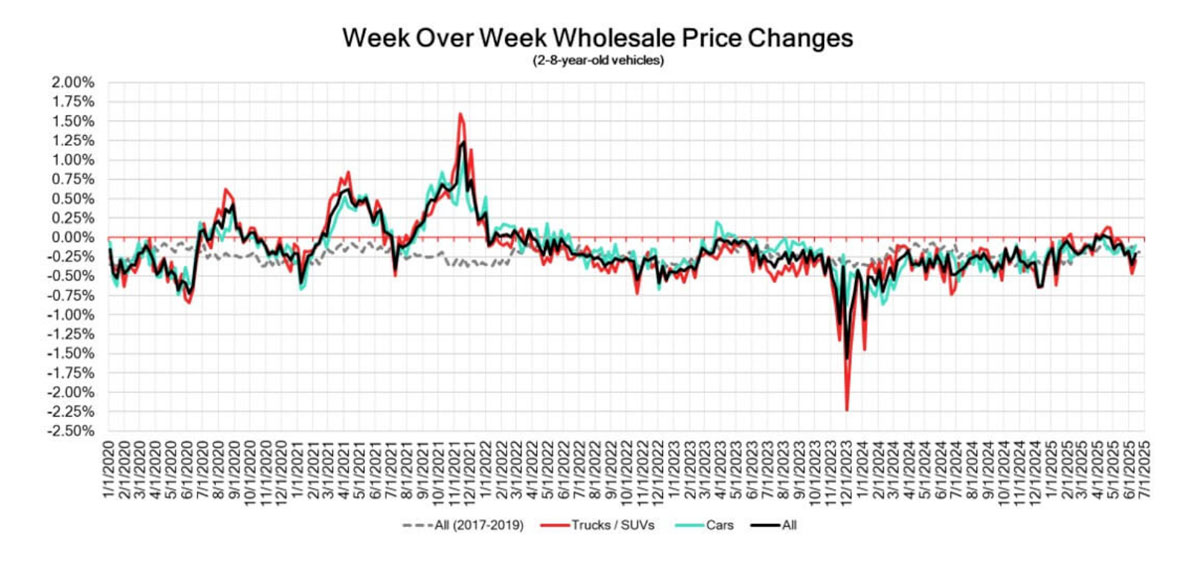

The Canadian used wholesale market’s decrease in pricing continues with a decline less pronounced than in its previous week — down -0.21% for the period ending on June 14 compared to the prior week’s -0.35%, according to Canadian Black Book.

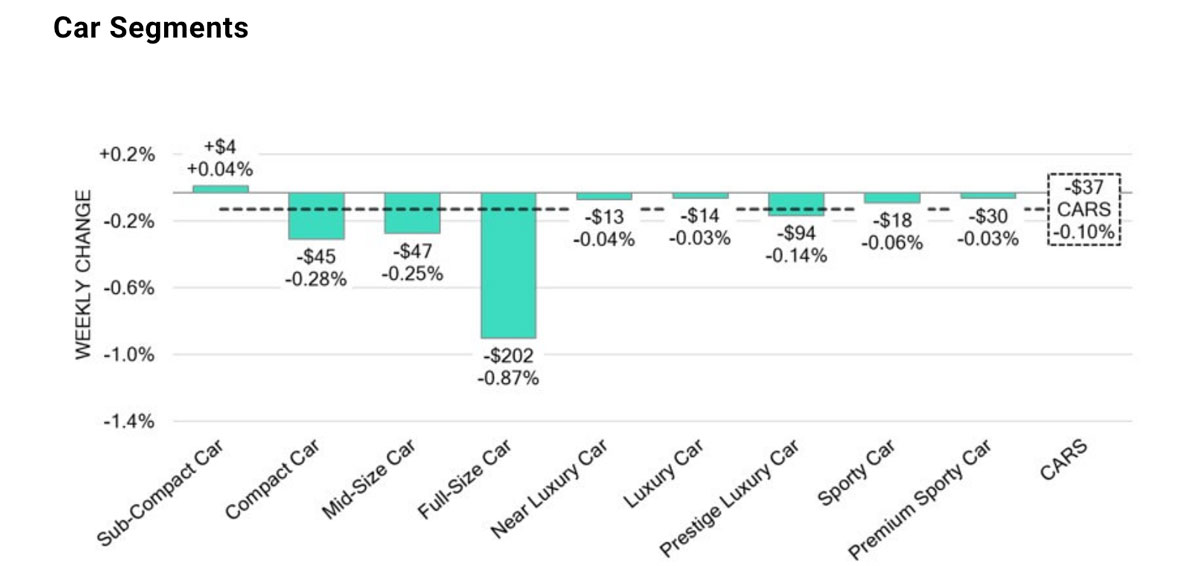

Car segment prices slipped -0.10% versus the -0.21% the previous week, while truck/SUV segments decreased by -0.30% compared to -0.47% a week earlier. The largest declines from cars came from the full-size car category (down -0.87%) and compact cars (-0.28%). Other notable decreases include mid-size cars (-0.25%) and prestige luxury cars (-0.14%). The exception was sub-compact cars, the only segment to enjoy a gain, up +0.04%.

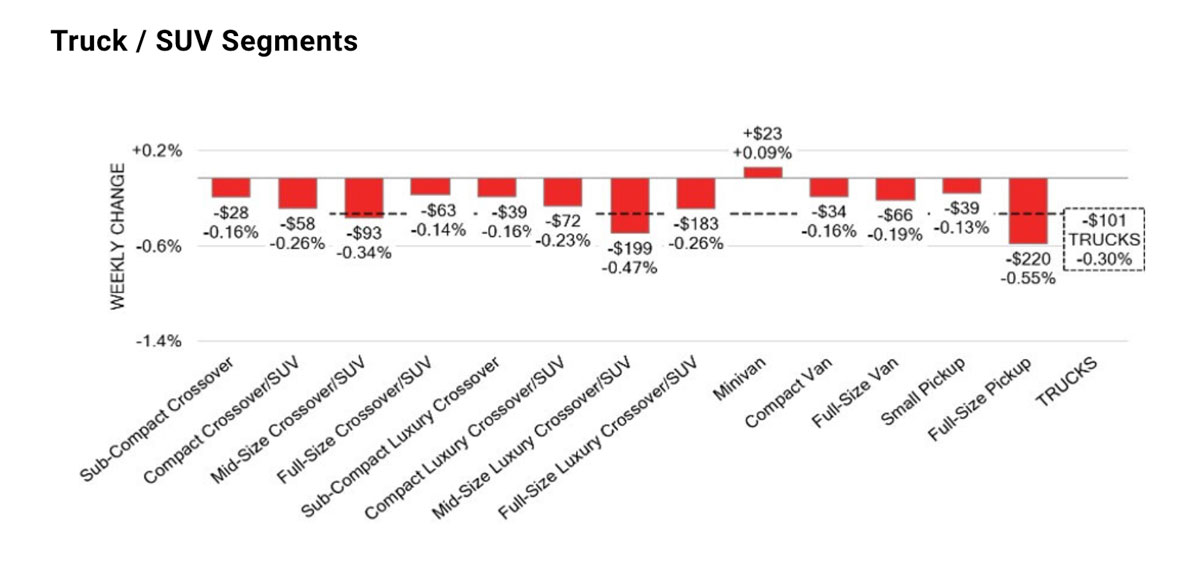

For trucks/SUVs the most notable declines came from full-size pickups (-0.55%) and mid-size luxury crossovers/SUVs (-0.47%). Others worth noting include mid-size crossovers/SUVs (-0.34%), compact crossovers/SUVs, and full-size luxury crossovers/SUVs (-0.26%). A modest uptick was seen in the minivan category (+0.05%).

“Just over 18% of the market segments experienced an average value change of more than ±$100,” said CBB in its Market Insights report. “Monitored auction sale rates ranged from 17% to 75.2% averaging at 44%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed to several factors, including ongoing political variances and the gradual change in floor prices.”

CBB said supply remains high compared to prior weeks, but upstream channels are gaining early access as there continues to be high demand on both sides of the border for more inventory at vehicle auctions.

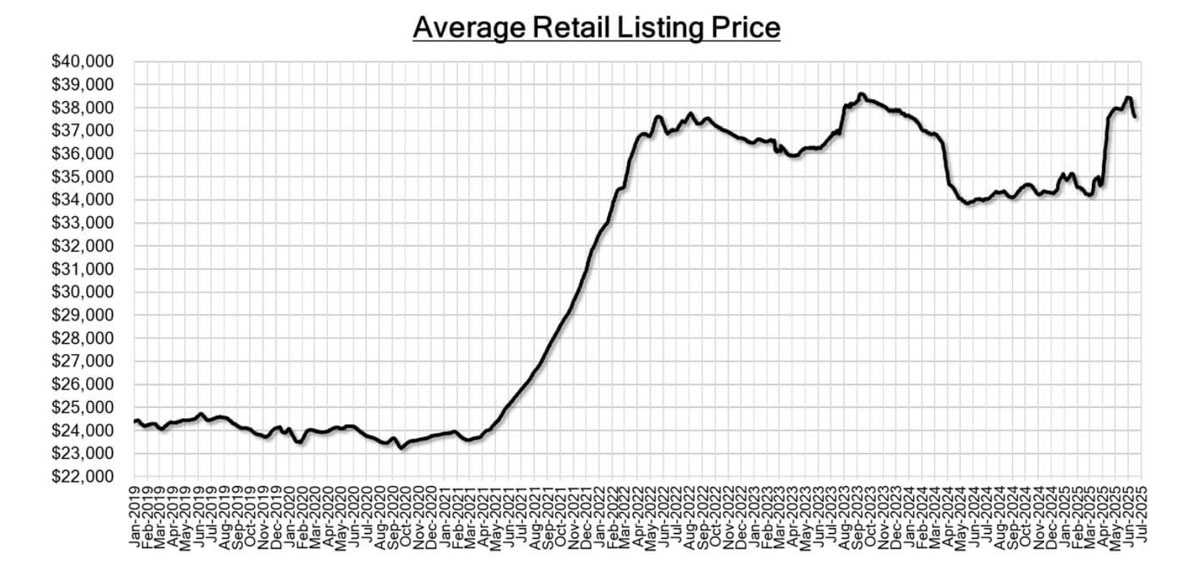

The average listing price for used vehicles, as per the 14-day moving average, was $37,600 — based on around 220,000 used vehicles listed for sale on Canadian dealer lots.

In other news, zero-emission vehicle sales were down year-over-year in April due to an absent federal iZEV rebate. However, CBB notes that at 7.5% in April, market share did improve against March, which came in at 6.5%. The Renault Group has expressed interest in bringing its sports car brand Alpine to Canada as its first entry into the North America market. And Ford Canada CEO Bev Goodman is pushing for Canada to repeal its ZEV mandate as consumer demand for electric vehicles has declined significantly.