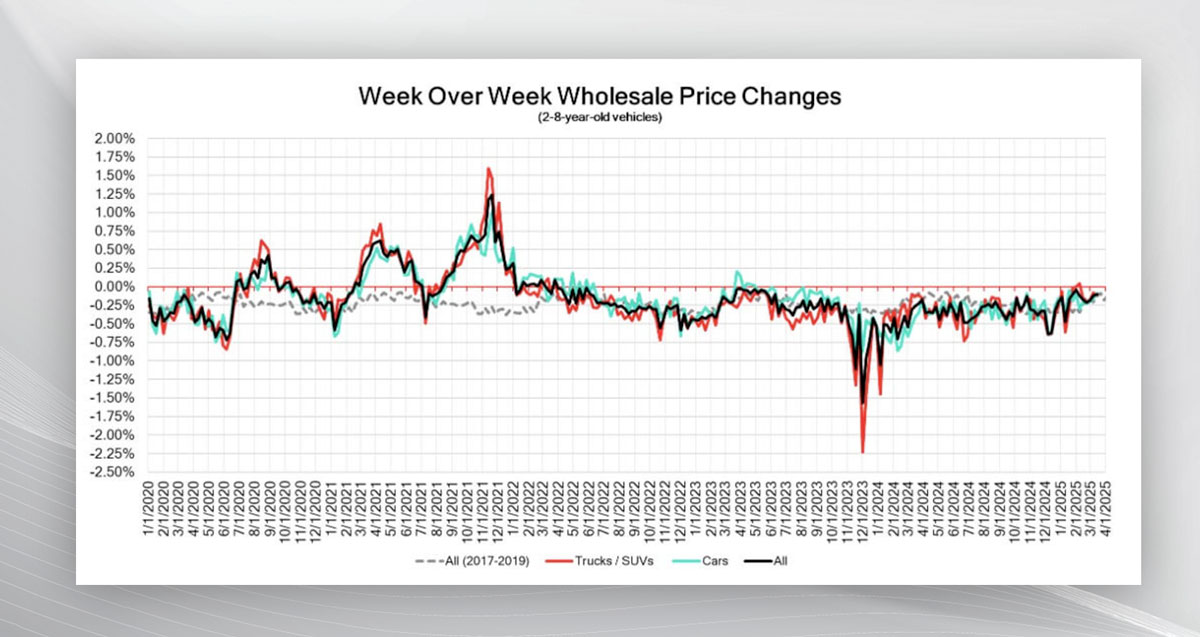

Dealers keeping tabs on the Canadian used wholesale market may be interested to find that pricing was down -0.10% for the week ending on March 15, according to a Canadian Black Book update. The decline is somewhat similar to the prior week’s report, and the 2017-2019 average for the same period.

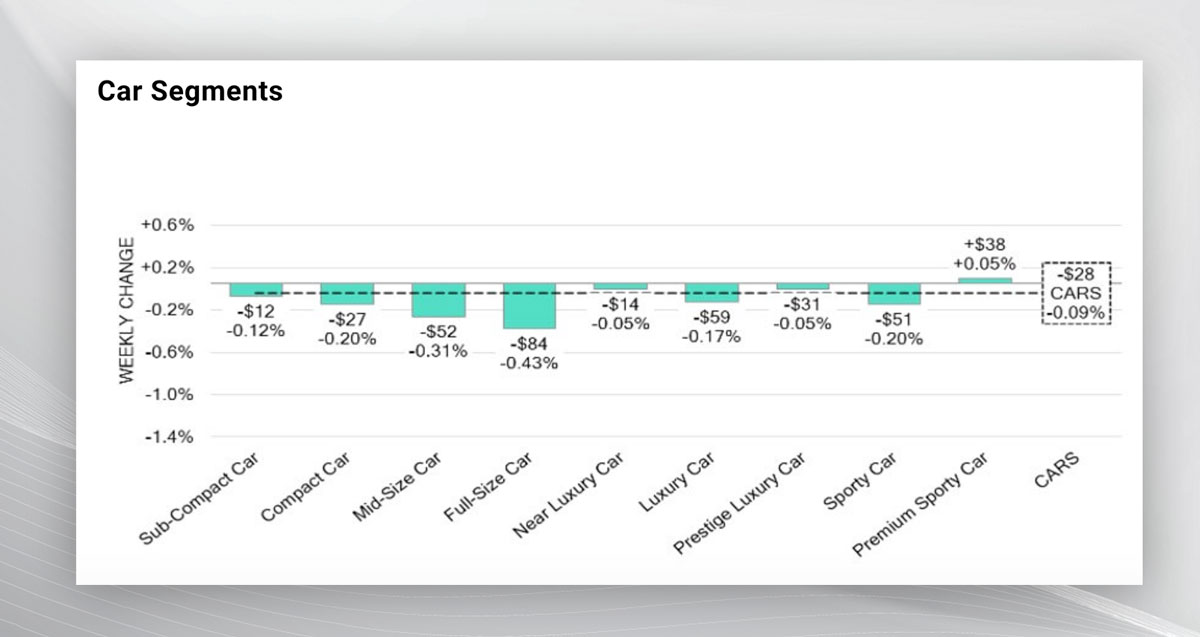

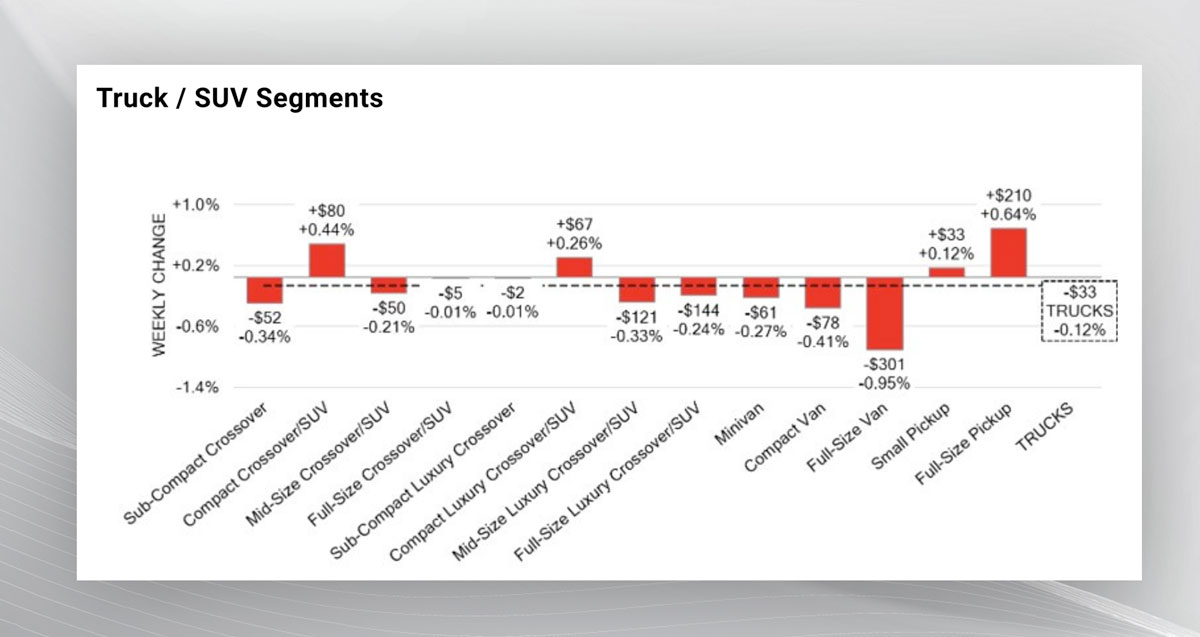

The report also found car segment prices slipped -0.09% from -0.16% a week earlier, while truck/SUV segment prices decreased by -0.12% (which is more than the prior week.) The largest declines in the car segments came from full-size cars and mid-size cars. For truck/SUV segments, it was full-size vans and compact vans. “Just under 19% of the market segments experienced an average value change of more than ±$100,” said CBB in its Market Insights report.

On monitored auction sale rates, these ranged from 33.3 to 69.7%, averaging at 51.7%. “There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed (to) several factors, including the ongoing gradual decline/change in floor prices and recent political variances,” said CBB. “A slight increase in supply entering the wholesale market has been noted, however upstream channels continue to gain early access.”

In the car category, the segments with the largest reductions were full-size cars (-0.43%) and mid-size cars (-0.31%). Compact cars and sports cars had the same decrease (-0.20%). And premium sports cars experienced an increase of +0.05%.

On trucks/SUVs, the segments with the largest declines were full-size vans (-0.95%), compact vans (-0.41%), and sub-compact crossovers (-0.34%). The segments that saw an increase in values were full-size pickups (+0.64%), compact crossovers/SUVs (+0.44%), and compact luxury crossovers/SUVs (+0.26).

CBB noted the average listing price for used vehicles is slightly decreasing, as the 14-day moving average sat at $35,000. Their analysis is based on around 220,000 used vehicles listed for sale on Canadian dealer lots.