Canada exported nearly 300,000 used vehicles to the U.S. in 2019, based on data from DesRosiers Automotive Consultants (DAC). The automotive export community has enjoyed strong and large profits. However, Canada is the smaller market with less influence and the path it has taken, different in many ways from the U.S., has created slightly different results, according to Canadian Black Book.

Canada exported nearly 300,000 used vehicles to the U.S. in 2019, based on data from DesRosiers Automotive Consultants (DAC). The automotive export community has enjoyed strong and large profits. However, Canada is the smaller market with less influence and the path it has taken, different in many ways from the U.S., has created slightly different results, according to Canadian Black Book.

“The pandemic crisis creates an entirely new set of variables that are unique to each nation, and each will have their own specific impact on the market and economic conditions of each country,” said CBB. “The more severe and longer lasting lockdown measures in Canada created a drop in prices that was not as sharp but was longer lasting.”

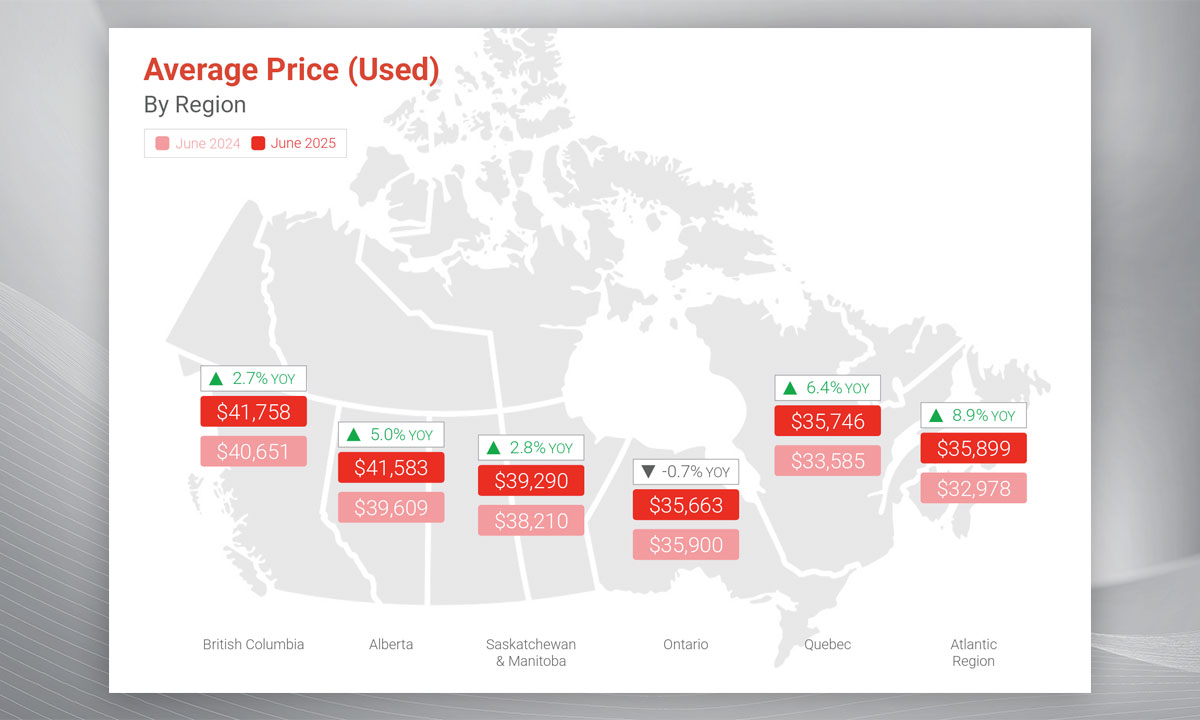

CBB said the significant decline and sharp rebound in wholesale prices experienced in the U.S. market has not yet appeared in Canada. And there has been a lift in prices, which CBB describes as “more of a pause in value declines” rather than a boost in values.

The large number of units exported on a weekly basis, from Canada to the U.S., has maintained a constant level of demand — this, when many retailers were dealing with low volumes. It is a key factor that helped manage the loss in values in Canada, and all while COVID-19 declines were pushing values down.

The federal government assistance response was unique to each country, and significant in how the things turned out.

“In general, the U.S. market has been influenced by fewer initial COVID-19 restrictions on the population and businesses,” said CBB. “The generous U.S. government assistance payments, resulting in a significant ‘raise’ for some of the lowest income earners, have helped to drive vehicle demand up.”

They add that both auction and retail markets opened up more quickly in the U.S. than in Canada — key differences that have led to differing market behaviours. However, the high number of COVID-19 cases and deaths in the U.S. could have a “dragging effect” on the economy and its ability to recover in a timely manner.

“The two adjoining nations have always had different economic stories, as far as wholesale and residual values are concerned, and this continues to be the case during this challenging time,” said CBB.

Used vehicles supply projections indicate significantly higher supply in the wholesale marketplace for the coming months. This will be due to a number of factors, including supplies being tight, and months of reduced sales and a reduction of trade-ins have depleted the number of units available to buy and sell on the wholesale market.

According to CBB, this is a temporary situation and more supply is anticipated in the coming months — particularly with lease returns and repossessions going up.

Other factors include delayed lease returns (due to lease-term extensions offered by OEMs now coming back to market), extensive de-fleeting by rental car companies, and the expectation that corporate fleets will be reduced thanks in part to smaller operations and a need for cash.

To read the full report, click here.