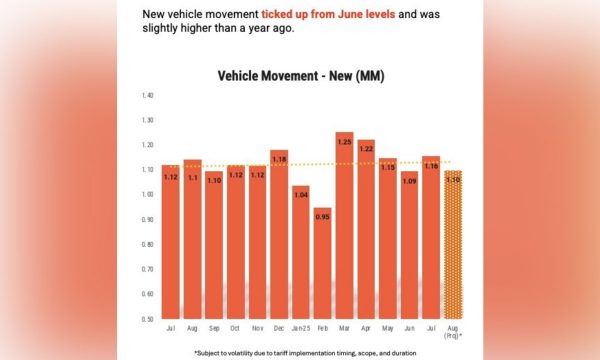

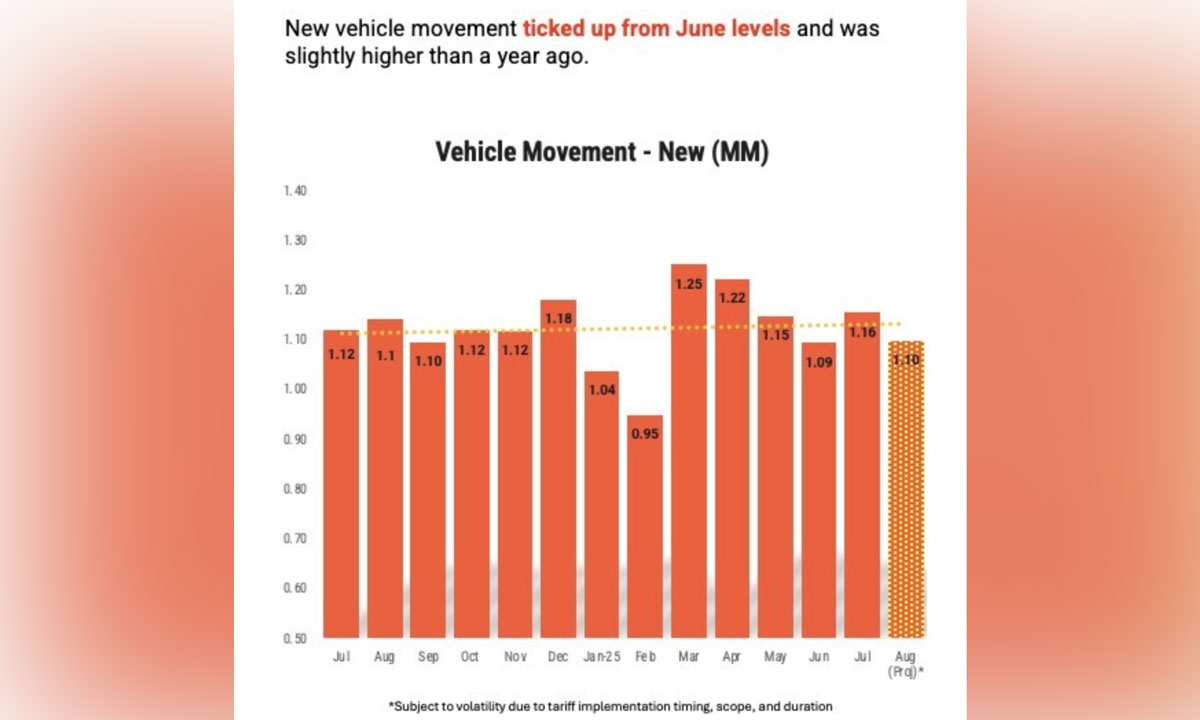

September U.S. new-vehicle sales are anticipated to show a resilient market — one that continues to shake off key policy changes and economic uncertainty, according to a report from Cox Automotive.

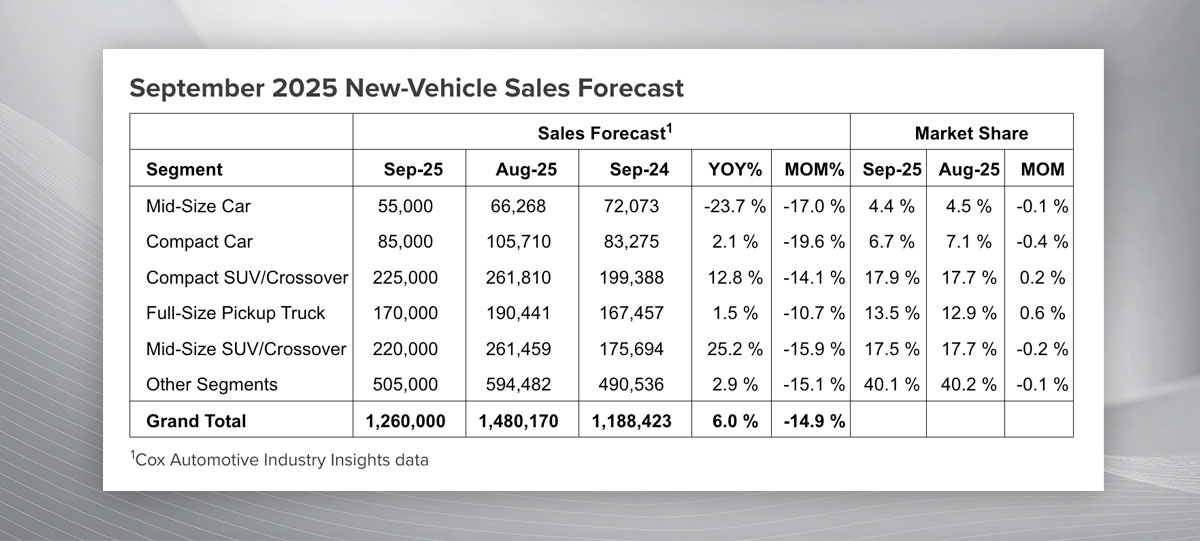

Based on the company, the September new-vehicle SAAR (Seasonally Adjusted Selling Rate) is expected to finish near 16.2 million, up from last year’s 15.8 level and slightly higher than last month’s 16.1 million pace. The company said sales volume is expected to increase by 6 per cent from 2024, but also decline 14.9 per cent from the previous month thanks to three fewer selling days.

“The new-vehicle sales pace has been surprisingly strong this summer and through the third quarter as uncertainty around tariff policy has decreased,” said Charlie Chesbrough, Senior Economist at Cox Automotive, in a statement. “Continued low inflation and unemployment rates, coupled with a strong stock market, have kept consumers in a buying mood.”

Chesbrough said a key contributor to sales in recent months has been an increase in electric vehicle sales, due to consumers rushing to buy a vehicle before the $7,500 tax credits expires at the end of September. As a result of the surge, Cox Automotive is forecasting that a record 410,000 EVs will be sold in the third quarter. That’s a sizable increase of 21.4 per cent year-over-year and a jump of more than 30 per cent compared to the second quarter.

They said the share of EV sales in the third quarter will likely reach around 10 per cent of total sales, which would be a record as the previous peak in EV sales in the U.S. was 365,824 units in Q4 2024. That accounted for 8.7 per cent of total new vehicle sales.

“The federal tax credit was a key catalyst for EV adoption, and its expiration marks a pivotal moment,” said Stephanie Valdez Streaty, Director of Industry Insights at Cox Automotive, in a statement. “This shift will test whether the electric vehicle market is mature enough to thrive on its own fundamentals or still needs support to expand further.”