Solid attendance and good networking opportunities were just some of the highlights

In the years ahead, prospects look good for Nova Scotia’s auto dealers, but they will have to adapt to better serve the next generation of buyers, dealers were told at the CADEX East management conference on Friday April 4 in Halifax, Nova Scotia.

The annual half-day conference, organized by the Nova Scotia Automobile Dealers Association (NSADA) is followed by a President’s dinner that brings out the who’s who of the province’s auto dealer and supplier community.

Some of the dealers we interviewed said the event was top notch, information packed, and provided lots of useful nuggets they could take back to their dealership.

The event kicked off with a keynote address by Maria Soklis, VP and COO of Kia Canada Inc.

Soklis shared her perspective on some of the trends affecting the automotive retail sector and focused on the so-called “Millennials” — that large group of potential car buyers who are not yet active in the market. Millennials are the group that follow the Generation X demographic and were born in the 1980s and 1990s.

Maria Soklis

Soklis says this group has different values than previous generations, and for many of them, cars don’t matter as much as other items — like their smartphones and mobile devices. “Young people today worry more about having a cool phone. So much of their socialization is conducted through that device, “says Soklis. “The car has become somewhat diminished.”

When cars lose some of their allure as a status symbol, this leads young people to put off a vehicle purchase, she says. Many of them also have a negative perception of automobiles, and see walking and biking as more environmentally friendly transportation options.

“How do we overcome these challenges?” she asked. For Kia, she says the company is trying to build cars that will matter to them. That means responding to what she describes as five imperatives: technology, risk taking, the environment, value and sales.

To attract these buyers, vehicles will need to feature bold design, cutting-edge technology, deliver better fuel economy and provide greater value. Furthermore, dealers will need to revamp their sales approach when it comes to dealing with consumers.

Since buyers arrive so well armed with information, the traditional sales approach just won’t cut it. “You need to ensure you are hiring the right people,” says Soklis. They need the right skill set and knowledge and communication, and interpersonal skills are more important than ever before. She says she’s confident dealers will make the transition, as they have a long history of adapting to trends — often before the OEMs.

In a question and answer session following her address, Soklis discussed issues such as digital marketing, social media, and dealership facilities.

FUTURE LOOKS BRIGHT

CADA’s Chief Economist Michael Hatch presented an overview of the national economic picture with a particular focus on local economic trends that are driving growth in the local economy.

Hatch says positive trends such as offshore resource development, vehicle affordability, and a consumer willingness to spend all signal good times ahead. He says the province’s dealers could be poised for another record-breaking year for vehicle sales in 2014, and can expect growth of about two per cent.

Used car sales are also important in the Atlantic market, because here, used vehicle sales are around twice that of new ones. The used car segment represents a $50 billion market at the national level, but the share of used car sales by dealers has dropped by 10 per cent over the last decade. As a result, dealers will need to focus more on their used car opportunities. “Used car supplies have tightened,” says Hatch, adding that the steady supply of off-lease vehicles isn’t as reliable as it once was.

Hatch also downplayed media hype about the risks related to rising levels of consumer debt — with average household debt now sitting at more than $27,000. He says he fields a lot of questions from the media about the role that vehicle loans play in adding to that mounting debt.

“Yes it is an issue. No it can’t go on forever. People can’t keep piling on debt the way they have been,” says Hatch. But low interest rates are helping them manage the debt, and delinquency rates on car loans are lower than they ever have been. “People’s debts are going up, but the absolute costs to service them is going down.”

Josh Bailey (left) and Kevin Bent

THE HOT USED MARKET

A remarketing panel explored the trends and technologies that are now impacting the used car market.

The panelists, Kevin Bent, CEO of Rides.ca, Josh Bailey, VP of Research and Editorial at Canadian Black Book, and Howard Connolly, the General Manager of Manheim Halifax, fielded questions from moderator Niel Hiscox, publisher of Canadian auto dealer.

Panelists tackled the difficulties of finding a supply of used cars. “Right now everyone is experiencing difficulty finding inventory,” says Josh Bailey. “I don’t think that is changing anytime soon.”

For his part, Howard Connolly said a lot of vehicles are being sold upstream, and don’t even make it to auction. “In the used car market, supply is short lived, “ says Connolly.

This lack of inventory is prompting dealers to take a closer look at keeping older high mileage vehicles they would have previously passed off to the independent market. Connolly said several independent used car dealers have closed in recent months in the Halifax area.

The tight supply and the lower Canadian dollar also means that more American buyers are starting to show up at Canadian auctions.

Kevin Bent says the new tools that consumers use to research used vehicles online are changing the landscape. “We are just scratching the surface in terms of how it affects consumer buying habits,” says Bent. “The buying cycle is shorter than ever.”

Consumers read reviews, check out inventory online, and now visit an average of 8.1 digital sites doing their research. “Consumers are very well prepared,” says Bent. But the good news for dealers is that consumers now only visit 1.2 dealerships before they make their purchase. “When they show up at your dealerships they are ready to make a purchase.”

For his part, Connolly says technology has also transformed the auction business, with more vehicles being sold online. “The sky’s the limit on the technology and I think the dealers will reap the benefits.”

The technology and tools available for dealers to post, source and managed used vehicles today can also be overwhelming. “I don’t envy you on that,” says Bailey.

Panelists were also asked about how the role of dealers would change in the mix as these trends continue. Bailey says one dealership has already transformed their sales process so that customers who just want a test drive don’t have to interact with a salesperson. They set up appointments directly with test drive coordinators. “This is not going to be a pitch — it’s going to be a drive.”

But he says dealers will always have a role, particularly on the fixed ops side of the business. “If a ball joint goes there’s no downloading one of those over the Internet,” says Bailey.

FACTORY IMAGE PROGRAMS

Chuck Seguin, from Seguin Advisory Services, presented a fact-filled overview about research findings from the NADA / CADA Phase II study on factory image programs.

Seguin said the study yielded lots of interesting findings and helped combat some of the myths surrounding this hot button topic.

For instance, a lot of conventional thinking says OEMs want to standardize dealerships to replicate the Apple store experience. But Seguin showed a slide that illustrated that the exterior of many Apple stores look completely different. “Everyone wants to be consistent like the Apple stores,” says Seguin. “Nonsense.” While the interior of the stores have a certain consistency, they vary across jurisdictions.

When it comes to decisions on how to renovate or modernize a dealership, Seguin says it’s not always the OEM pushing for the large-scale changes. The dealers can be their own worst enemy, as their egos can compel them to overbuild their stores beyond the levels they need for their businesses.

There are fundamental differences in business outlooks that can also put OEMs and dealers at odds over facility expansion plans.

Both OEMs and dealers want to sell more cars, but dealers are also looking for capacity utilization and a return on investment. OEMs look a few years down the road where they think their brand is going to be in terms of sales. But dealers need to make investment decisions to support those forecasts that are 20 or 30-year commitments.

Seguin says the research to support the business case for investment is often lacking. “I found a lot of dealers do not get a lot of good information to support the investments,” says Seguin. “A lot of dealers complain they weren’t supplied with the proper data to make a decision.”

At the bare minimum, dealers should be asking for a third-party market study from their OEMs. If they don’t provide one, dealers should do one on their own.

OEMs will sometimes engage in “copycat” market expansion to keep up with another competitive brand, and overstate the potential of their brands. The “if you build it they will come approach” doesn’t always pan out for the dealers who are footing the bills for the expansion.

In researching the report, Seguin says neither dealers nor OEMs could provide any data to support the ROI on showroom investments. It’s much easier, however, for dealers to quantify the return on the fixed ops side of the business. “If you expand service bays, you will make more money, “ says Seguin.

Another key finding was that dealership modernization on its own doesn’t lead to a significant ROI. But if you match modernization of a dealership with process change — improving the flow of customers through the dealership, investing in amenities for the customer, and making things work more smoothly — then the ROI goes through the roof. “Bricks and mortar doesn’t amount to a lot but what you do within those walls makes a huge difference,” says Seguin.

The most contentious issue with dealers is the need to standardize to be in alignment with OEM brand and facility standards. These efforts don’t yield any significant ROI, particularly in the short term.

In many cases, revenues will go up after a major dealership retrofit — but expenses go up at a bigger rate, resulting in a drop in profitability.

Seguin concluded that there are no simple answers when it comes to facility upgrades and image programs. It depends on a lot of factors, and many of those are not within the dealer’s control. He says dealers need to trust their business instincts and leave their egos aside when they consider these investments.

Paul Potratz

LET’S GET SOCIAL

Paul Potratz, one of North America’s top speakers and experts on digital marketing and social media returned to CADEX again this year.

Potratz dazzled attendees with the latest trends in online marketing and the benefits of social media. Some of what he presented was a tad creepy — like how your smartphone has an ID that can track your location, the contents of your text messages and email and much more. “We are able to put people in buckets and market to them,” says Potratz. “Now you can target an individual based on their behaviour.”

Canadians are “socialites” and are more engaged in social media than Americans. “Your market is more plugged in than anyone else,” says Potratz, citing stats that show Canadians are now spending 5.4 hours a day online in 2014 on their desktops and 3.9 hours on their mobile phones.

He says 30-40 per cent of dealership traffic is now coming via mobile devices. “Mobile is exploding,” says Potratz.

One key message Potratz delivered was for dealers to pay closer attention to the signals people provide when they are on their social media sites, particularly Facebook. “With social media, people are telling you their hot buttons,” he says. “With social media you can target that need — you can target that desire.”

Potratz also advised dealers to stop being distracted by the latest “can’t miss,” social media sites like Pinterest, or Instagram or a host of others. He says focus on Facebook. “Facebook is not here to stay. It will be pushed out,” he says. “But today it’s a powerhouse.”

FIRESIDE CHAT

The last session of the day featured an informal “fireside chat” with moderator Niel Hiscox asking questions to Rick Gauthier, President and CEO of the Canadian Automobile Dealers Association.

Gauthier shared some of the key takeaways from the recent CADA Summit held in Toronto, and expressed his thoughts on the outlook for the auto industry in 2014. “I am an optimist by nature,” says Gauthier. “The industry is up every month over last year for January, February and March,” he says, adding that consumer confidence is also up. “I am feeling pretty good.”

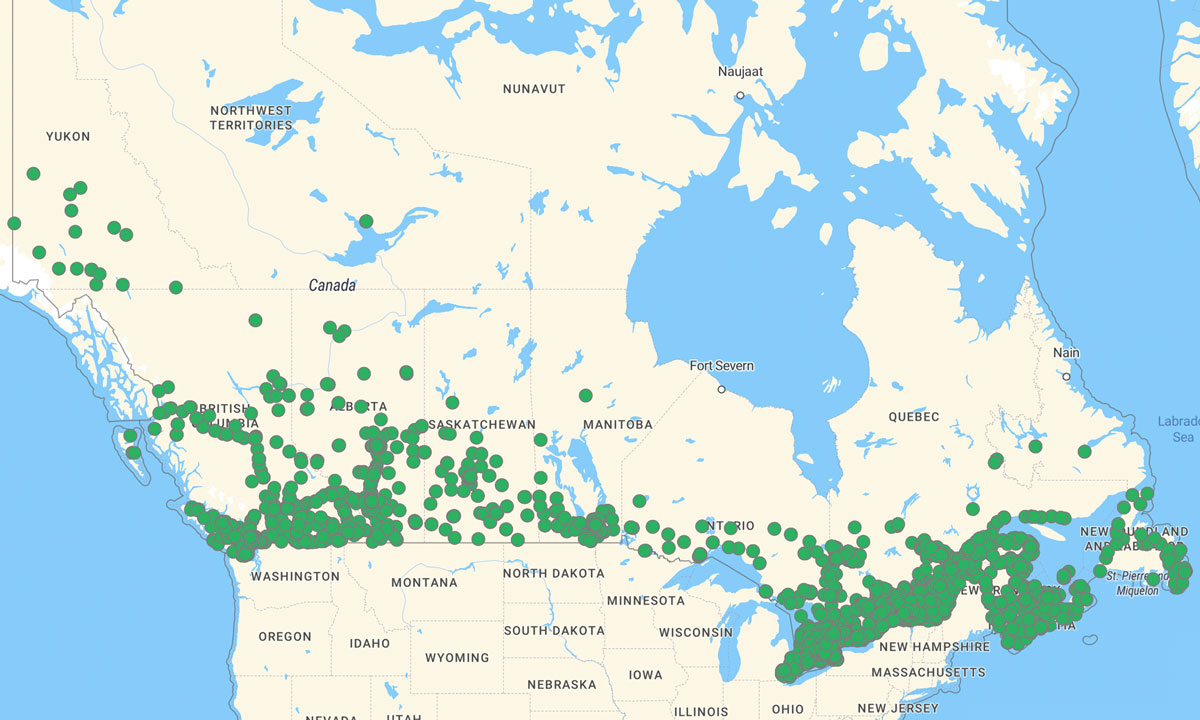

Gauthier also shared his views on the growth in dealership consolidation that continues at a rapid pace across the country. Already, dealership groups sell about 60 per cent of all the cars and trucks, and there are only about 1,800 independent operators left in Canada.

The trend towards consolidation is also fueled by the “succession crisis” in the industry with dealers who are often more eager to cash out to a big group when they have a chance rather than transfer the business to the next generation.

Gauthier says he expects the consolidation trend will plateau in the next five years, as the consolidators will have rounded out their portfolios.

Eventually, public companies might be more common in Canada as they will be the only ones with enough capital to acquire large dealership groups. Although OEMs aren’t keen on having public companies join their networks, they might have to change their tune, says Gauthier.

Gauthier also reviewed some of the other files that CADA is tackling, such as fighting the Canada Revenue Association over their contention that dealers need to pay tax on their finance income, fighting mandatory vehicle labels, and reinventing the federation of dealership associations.

Gino Cozza, head of sales at TD Auto Finance, and the exclusive sponsor of CADEX closed the day by thanking dealers for attending. “Our goal is to be the leader in the auto space,” says Cozza. “We see an opportunity to become your one-stop shop for financing.”

For more information visit: www.cadexnovascotia.com